The sterling has been particularly subtle to Brexit developments over the last few months. In last month, the EU determined that ‘sufficient progress’ had been made on divorce-related matters - which included coming to a financial settlement in the region of £35-40bn, no hard border between Northern Ireland and the Republic of Ireland and agreeing on the rights of EU citizens – allowing discussions to move onto the nature of the future trading relationship.

Initial statements from Brexit Secretary Davis and EU Chief Negotiator Barnier have highlighted how negotiations could yet test the unity of both sides. Davis has suggested that the UK is aiming for a ‘Canada plus plus’ deal, adding that the intention through negotiations is to treat goods and services as ‘inseparable’.

However, Barnier has already outlined that there will be no ‘special’ treatment for the UK financial services sector. Interestingly, the Bank of England has indicated that it will not be changing the rules for EU banks operating in London, even in the event of a ‘no deal’. While the risk of a disorderly Brexit has fallen, it nevertheless remains a key risk factor for EUR GBP in particular.

The fundamental motivation for owning GBP volatility was colored by uncertainty on multiple fronts – around the Brexit process, increasingly dysfunctional domestic politics, continued debate around the abrupt change in the BoE’s reaction function and the risk of an unwind of rate hikes priced along the yield curve should growth and/or politics intercede.

While implied and realized vols have collapsed over the past month following the tentative political agreement on a stand-still two-year transition period once the UK leaves the EU next March. But the more important issue – the nature of the UK’s new trade arrangement with the EU – remains to be determined, and as such, there is scope for fresh instability around the Brexit process this year, even if the process looks relatively free of drama for the next few months. Meantime, we remain to be convinced that prosaic economic fundamentals are conducive to a stable, low volatility recovery in the pound.

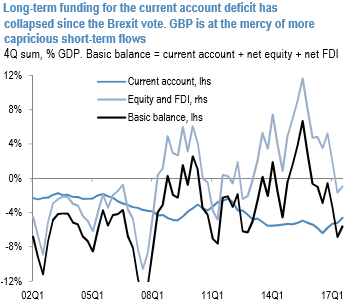

The economy is chronically underperforming the Euro area (in this sense Brexit is already exerting a palpable drag on the economy) and the UK’s current account deficit, which is still of the order of 4.5% of GDP, is now entirely reliant on short-term funding as inflows of equity and FDI into the UK have collapsed following the Brexit vote (refer above chart). This creates a potentially unstable backdrop for GBP and increases the sensitivity of the pound to future BoE policy. Courtesy: JPM

Trade recommendation: Long a 1Y vol swap in EURGBP. Initiated at 8.85%. Marked at 7.00%.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data