Sterling kept out of bullish sentiments as the GBPJPY and GBPUSD resumes price slumps again from the week's high.

Fundamentally, as we continue to foresee the trade apprehensions rachet up, the British pound likely to prolong bearish streaks amid minor spikes against the Japanese yen in a typical “risk off” move. We’ve listed out a few factors that likely to drive GBPJPY bearish scenarios.

Bearish GBPUSD, GBPJPY scenarios:

1) BoE rate hikes are delayed until much later in 2018 as core CPI continues to moderate and wages remain sticky below 3%;

2) The UK and EU fail to agree on the Irish border, leading to a non-negotiated Brexit);

3) Overt balance of payments pressure.

The UK’s exit from the EU will have significant repercussions for the financial industry, notably investment banking. London as the primary European hub is likely to lose its full access to the single market. Currently, financial services exports play a major role in Britain and almost half of them go to the EU. Without the surplus it generates from providing investment banking services to EU customers, Britain’s current account deficit would be 40% higher. Following Brexit and the likely loss of the single European passport, non-EU banks will have to set up or build-out subsidiaries in the EU-27 with own capital, liquidity, corporate governance and fully-fledged operations. This could lead to an additional EUR 35-45 bn of capital being ‘ring-fenced’. This represents a further leg of banking balkanisation with trapped capital, liquidity and resources – profitability will be under pressure and not all EU business models will be viable.

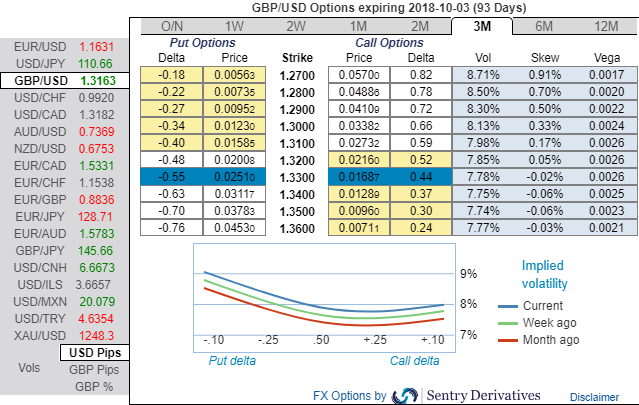

OTC outlook: All these bearish driving forces seem to be factored-in OTC markets. Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.27 levels (refer above nutshell evidencing IV skews).

Although you can observe the shift in positive risk reversal numbers of cable (GBPUSD) signalling bearish risks intact, whereas, bearish risks remain intact in long-run (refer above nutshell showing risk reversals). 1-month forwards also substantiate the bullish targets, mild price upswings are anticipated.

Options Strategy (GBPUSD PRBS):

Contemplating above factors, put ratio back spreads a couple of days ago were advocated. Short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 1m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -99 levels (which is bearish), while hourly USD spot index was at 68 (bullish) while articulating (at 08:02 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts