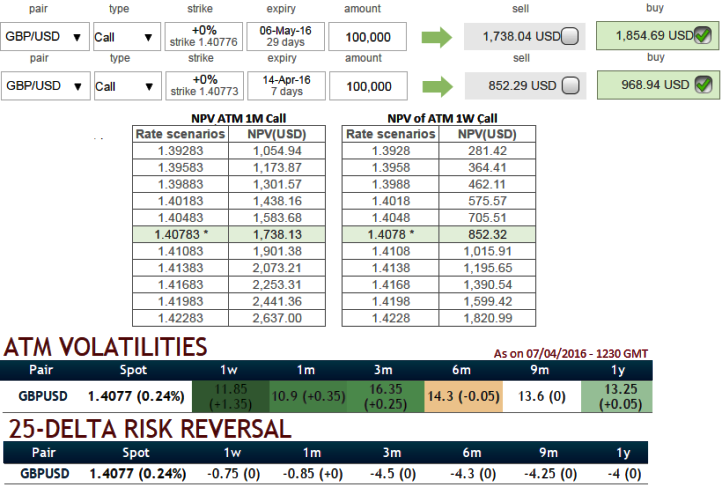

ATM IVs of GBPUSD are at 11.85% for 1w expiries and 16.35% for 3 months tenor, while extremely negative sentiments signalled by delta risk reversal numbers on all expiries.

1W ATM call premiums – Trading 13.61% more than NPV.

3M ATM call premiums – Trading 6.67% , more than NPV which is reasonable compared to ATM IVs.

Brexit risks are crystallizing around Jun/Sept: steep GBP skews provide attractive put spread hedges.

The potential Brexit risk premium have begun to be priced into options, OTC markets are evident to display this scenario, OTM puts are getting overpriced. The risk would aggravate once it is clearly scheduled. The likelihood of the event favor a 1Y bearish risk-reversal in cable (temporal Fed-BoE policy divergence could weaken cable before the political risk premium kicks-in mid-year).

One can very well empathize this from the delta risk reversal nutshell, the highest negative hedging set ups among G7 currency spaces. As it showed the highest negative values, it relatively indicates OTM puts are more expensive than OTM calls (downside protection is relatively more expensive).

Hedging Framework:

Please observe as to how the delta risk reversal numbers are getting higher negative values gradually as the time progresses in a long run. Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

Go long 3M At the money delta Call, Go long 6M at the money delta put and simultaneously, Short 1M (1.5%) at the money call with positive theta.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed