Bearish AUDUSD Scenarios, see below 0.65 if:

1) the RBA cuts rates more quickly than we expect;

2) the Fed doesn’t deliver on market pricing for rate cuts in 2019;

3) the trade conflict between the US and China broadens;

4) the global economy slows more than expected, risking recession into year-end.

Bullish AUDUSD scenarios, see above 0.70 if:

1) China eases policy more forcefully and commodities rally on the back of future infrastructure spend;

2) the Australian government commits to large fiscal easing, shoring up growth prospects and reducing the need for a further 50bp of easing from the RBA;

3) the Fed surprises with a more aggressive easing cycle than priced.

We have made no changes to our year-ahead AUDUSD forecasts and still see AUD at USD 0.65 by Q2’2020 on the back of a weaker growth backdrop for the global economy and our expectation of further easing from the RBA in H1’20. The risk of further escalation in trade tensions adds to the downward bias for AUD over coming quarters, even if the RBA manages to execute a pause in its easing cycle for the next few months.

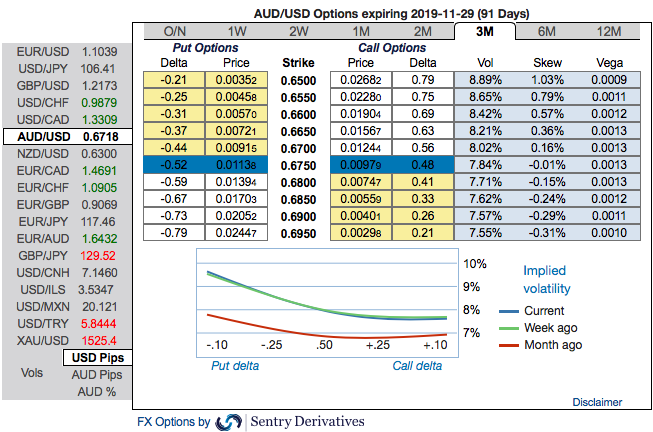

Contemplating above factors, we will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

OTC Updates:

Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes up to 0.65 levels which is still in line with the above-stated bearish projections (refer 1st nutshell).

Please also be noted that the minor positive shift in risk reversals (RRs) of the shorter tenors and bearish RRs of the longer tenors that are also in sync with the bearish scenarios refer 2nd (RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear. While the 3rd chart of OTC Volumes Index which is the barometer of volume on liquid contracts of AUDUSD that signifies the highest number of volumes took place in OTC FX markets.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

The rationale: Bidding above 3m IV skews, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m lower IVs to optimize the strategy.

Bearish outlook with rising volatility good for the option holder. While put writers would be on upper hand on theta shorts in OTM put options that would go worthless on lower IVs as the underlying spot FX keeps rising,. Thereby, the premiums received from this leg would be sure profit.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, JPM, and Saxobank

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge