Bullish GBPAUD Scenarios:

1) The government announces a much more stimulatory budget in March (the manifesto envisaged fiscal thrust of 0.4-ppt for 2020 and nothing thereafter).

2) Johnson eventually acknowledges the need for a lengthier transition period.

3) The government softens its stance and agrees to closer regulatory alignment to maintain frictionless trade.

4) The RBA cuts rates more quickly than we expect;

5) The trade conflict between the US and China escalates again and broadens.

Bearish GBPAUD Scenarios:

1) The UK economy fails to rebound after the election.

2) The BoE cuts rates in January or March.

3) Johnson refuses to soften his trade stance, leading to an even greater risk of a no deal exit at the end of 2020.

4) Momentum builds for a 2nd referendum on Scottish independence.

5) China eases policy more forcefully and commodities rally on the back of future infrastructure spend;

6) The Australian government commits to large fiscal easing, shoring up growth prospects and reducing the need for a further easing from the RBA in coming months.

From the last 9-months or so, GBPAUD has been spiking from the lows of 1.7208 to the current 1.8186 level amid mild downswings in between. Technically, we could foresee minor price dips in the short-run and major uptrend likely to prolong further.

Hedging Framework:

3-Way Diagonal Options Spread

Ratio: (Long 1: Long 1: Short 1)

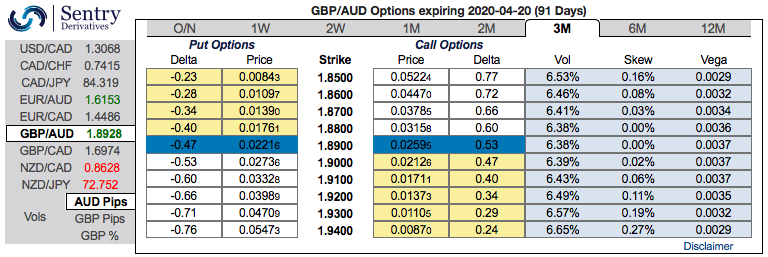

The execution: Initiate long in GBPAUD 3m at the money delta call, long 6m at the money delta put and simultaneously, Short theta in 1m (+1.5%) out of the money put with positive theta or closer to zero (spot reference: 1.8929 level).

Rationale: Contemplating 3m IV skews that are well balanced on either side (positively skews on both OTM calls and OTM puts), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

We reiterate, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD has currently been trading in non-directionally but with some bearish pressures. Hence, we advocate the above hedging strategy with cost-effectiveness that could hedge regardless of the swings on either side.

Alternatively, on hedging grounds, we advocate initiating longs in GBPAUD futures contracts of February’2020 delivery as further upside risks are foreseen in the short-run and simultaneously, shorts in futures of April’2020 delivery.

Thereby, the foreign traders, who are dubious about puzzling swings, can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: JPM & Sentry

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures