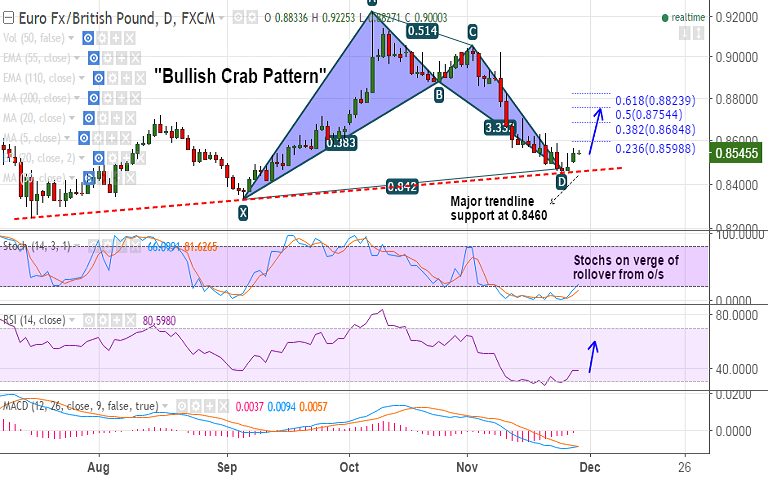

- We see a 'Bullish Crab Pattern' on EUR/GBP daily charts.

- The pair has taken strong trendline support at 0.8460 and edged higher.

- Stochs are on the verge of a rollover from oversold territory.

- RSI has edged higher from near 30 levels and MACD line is on verge of a bullish crossover on signal line.

- Focus today is on German preliminary CPI data which is expected to record a 0.9% y/y rise from October’s print of 0.8% y/y.

- Support levels - 0.8503 (5-DMA), 0.8460 (trendline), 0.84, 0.8344 (Aug 4 low)

- Resistance levels - 0.86 (23.6% Fib), 0.8628 (100-DMA), 0.8658 (20-DMA)

Recommendation: Good to go long on dips around 0.8530, SL: 0.8460, TP: 0.86/ 0.8630/ 0.8660

FxWirePro's Hourly EUR Spot Index was at 6.28479 (Neutral), while Hourly GBP Spot Index was at -90.0553 (Bearish) at 0425 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.