Bearish: USD/JPY to 125 if

1) The strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength,

2) The Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations.

Bullish: USD/JPY to 100 if

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness.

OTC indications:

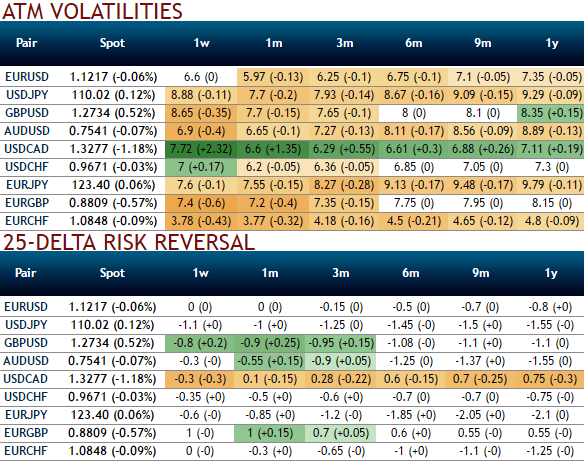

The implied volatility of ATM contracts of USDJPY are trading at around 7.7 – 7.9% for 1-3m tenors, the spike in IVs among G10 FX space appears to be conducive for put option holders as the delta risk reversals flashing up progressively with negative numbers that signify hedging arrangements for downside risks over the period of time.

Option Strategy:

We maintain our previously advised “knock out option spread” strategy.

Trade mechanism: Buy a 2m put spread strike at 111/109 with a KO at 115 on the long put. The maximum payout reached and below 109 is about six times the premium.

The rationale for the trade:

After the FOMC meeting, an even faster Fed is unlikely, eroding dollar gains potential.

Timing and entry point to sell USDJPY now are technically compelling.

USDJPY volatility is trading at its lowest level since the start of 2016.

IVs and risk reversals of this pair in OTC FX markets are indicative of bearish risks in the weeks to come.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise