Bullish USDJPY scenarios: The pair is likely to travel towards 120 if

1) US inflation fast-tracks, which indicates hawkish Fed hikes, ensuing in broad USD strength, and

2) Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations

Bearish USDJPY scenarios: One can expect 107 given that:

1) The global investors’ risk aversion heightens significantly, possibly due to deterioration in North Korea situation and/or US-Japan trade frictions, and

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness.

OTC outlook and hedging strategy (USD/JPY):

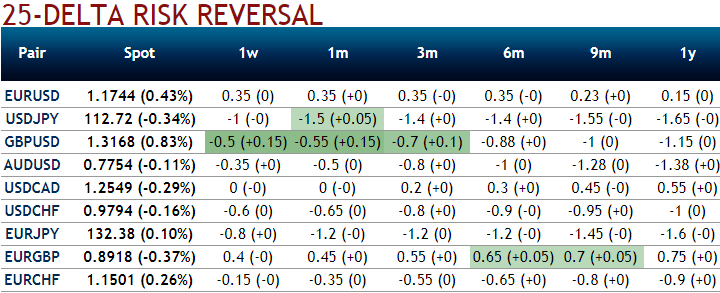

One could easily make out positively skewed IVs of USDJPY of 3m tenors are signifying the importance of OTM puts but not deep out of the money puts (suggesting strikes maximum upto 108 which is in sync with our above stated bearish forecasts). This bearish sentiment is also in sync with the mounting negative risk reversals that again indicates further bearish risks.

With the help of this OTC setup, the rationale is that any abrupt upswings should be optimally utilized to snap rallies and deploy short puts in order to reduce the cost of hedging.

Thereafter, to arrest potential downswings to maximum extent regardless of trading or hedging grounds, so to participate in that downtrend, weights of the long leg in hedging portfolio should be increased with more number of put contracts but consciously while choosing the right delta instruments.

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

Hence, we deploy ATM instruments in our below recommendation.

The strategy reads this way:

Add longs in 2 lots of ATM -0.49 delta put option of 3m expiries, while one lot of writing 1m OTM put with positive thetas. The strategy should be held with a view to arrest further downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -30 (which is bearish), while hourly JPY spot index was at 43 (bullish) at 06:17 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes