We’re adding EURAUD to boost our overall EUR exposure as the passage of the French election this weekend should clear the way for an intensification of portfolio inflows into the region in keeping with the cyclical acceleration in the region’s economy (the Italian election is too distant a prospect to command a risk premium).

AUD, by contrast, is likely to be weighed down, firstly by its stand-out sensitivity to China sentiment (underlying economic linkages and Australia’s status as a liquid proxy for China), and secondly by the downside risks to RBA policy in 2H17, including from a housing market that’s not liking its macro-prudential medicine.

There’s the risk of a tactical bounce in AUD from next week’s Federal budget (more infrastructure spending?), but this should be short-lived.

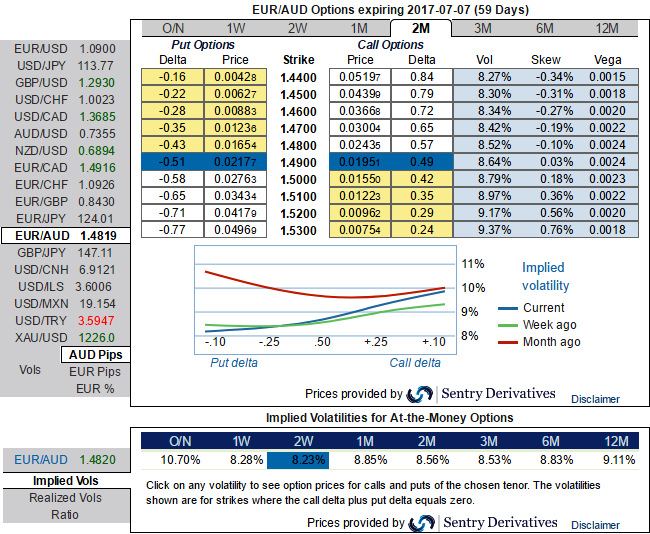

In the case of optionality, the 2m implied are projected to spike above the current realized (refer above nutshell).

Importantly, that the risk is essentially pricing in the bullish case, as it is linked to the possibility of volatile euro spikes. We articulate the euro’s technical trend against Aussie dollar in our recent post.

For more reading, please go through below weblink:

Thus, we like being short vol in short run, selling that premium conditionally on a pay-off benefiting from a lower spot.

Prefer a ladder to a call spread ratio As we expect limited spot appreciation and topside volatility, we recommend buying a 2m call ladder. Buy 1 ITM Call of 2m tenor, simultaneously stay short in 1m 1 ATM Call and Sell 1 OTM Call of positive thetas (strikes 1.4450/spot/1.5080).

That structure improves the odds compared to a call spread ratio as the maximum and constant profit zone is reached over a range instead of a single spot level.

However, risk is potentially unlimited above 1.5080, and investors would have to delta-hedge dynamically the trade in the event of fast upside.

Buy-and-hold structure and Greeks’ behavior: The above profile sells convexity. Being short gamma implies a buy-and-hold profile, as the full leverage can only be monetized at the expiry.

Finally, the short vega profile fits with the idea that a higher EURAUD should mean lower implied vol, consistent with the negative skew. Front-end risk reversals turned positive with the French election fetches as predicted results as Macron managed triumph (EURAUD has usually a positive skew).

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics