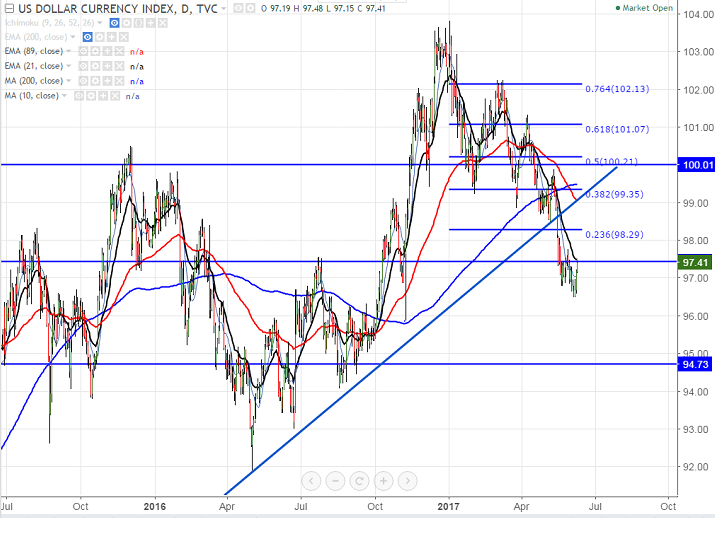

- US Dollar index recovered till 97.48 after making a low of 96.52. It is currently trading around 97.44.

- Short term trend is still weak as long as index not able to break above 98.29 (23.6% fibo). The index has shown a huge decline from the high 103.82 and downside capped by 61.8% fibo at 96.40 and bearish continuation can be seen below that level.

- The near term resistance is around 97.78 (May 30th 2017 high) and any close above will take the index till 98.29 (23.6% retracement of 103.82 and 96.52)/98.60 (support turned into resistance).

- On the lower side, major near term support is around 96.40 (61.8% fibo) and any break below will drag the index till 95.91 (Nov 9th 2016 low)/95.

It is good to buy on dips around 97.15-97.20 with SL around 96.50 for the TP of 98.25/98.60