Gold price seems to be the consistent standout under an investor positioning mean reversion rule with a success ratio of over 60% over the last five years and modest average monthly returns, albeit with a low information ratio.

As our trade moved into the money, we tightened our stop to avoid a loss. Prices moved below this level on June 23 and we closed at a profit.

Yellow metal prices kept sliding and now is on the verge of two-and-a-half month lows today and were on track to post a third straight session of losses as a recovery in the dollar hit investor demand for the precious metal.

Comex gold futures were at $1,234.67 a troy ounce by 10.58 GMT, down $7.63, or around 0.62%. It was the lowest level since May 16.

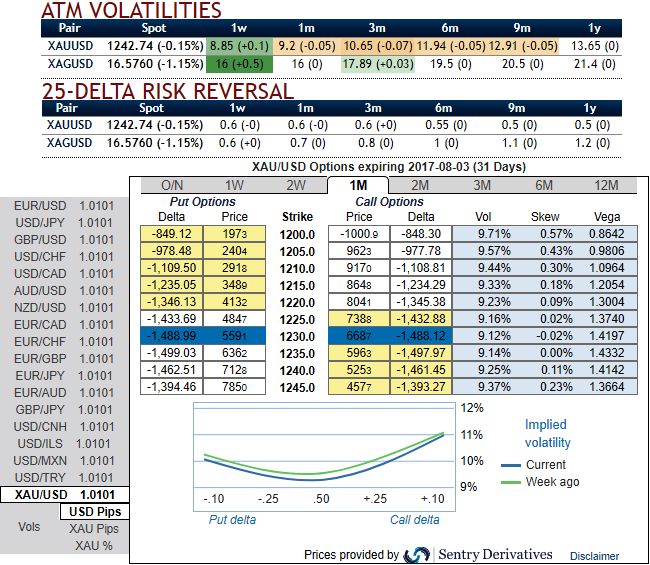

In our recent write-up, we had advocated 3-way straddles versus OTM Calls, the short leg on call has worked out so far. For now, we would like to reshuffle the option strategy as shown below.

Option Strategy: 3-Way Options straddle versus put

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in XAUUSD 1M at the money vega put, long 1M at the money vega call and simultaneously, Short theta in 1m (1%) out of the money put with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: The nutshell showing delta risk reversals above explains that hedgers’ interests have been neutral but upside risks are lingering, however, no new shift in sentiments is observed. While positively skewed IVs are also well balanced to signal the swings likely to oscillate on either direction. You could now again observe ETF positions have also surged in the last quarter.

As a result, we don’t see much traction OTM calls. While 1m – 1y IVs trending lower towards 9.2% to 13.65%. A seller wants IV to shrink away so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential