In this write-up, we refer to JP Morgan’s analytical piece and emphasize on the long vega exposure via cheap -6M6M/+1Y6M FVA 1*2 spreads for hedging the simmering broad-based risk sentiments.

The US-China trade developments remain very fluid and we are bound to see a few more adverse episodes.

The Cheap vega ownership could be deployed in anticipation of the vega tenors receiving more attention with the spot now under the watchful PBoC hand, we recommend using the favorable vol entry levels to add vega.

Utilizing attractive pricing and positive rolldown, 1x2 FVA spreads are time passage friendly and low maintenance long vega positions that struck us as a solid buy in the current environment where low decay vega is well sought after. The basic construct involves selling shorter-dated FVA along with the upward-sloping segment of the vol curve to partially fund the purchase of a longer-dated FVA that sits on a flatter part of the term structure. The roll-down of the short leg then compensates (or even eliminates, as is the case for CADJPY) the slide of the long position, all the while preserving the overall structure’s net long vol characteristic. The short leg is not large enough to disrupt the net positive sensitivity of the package to vol upturns. Consequently, the structure is a carry efficient risk-off hedge.

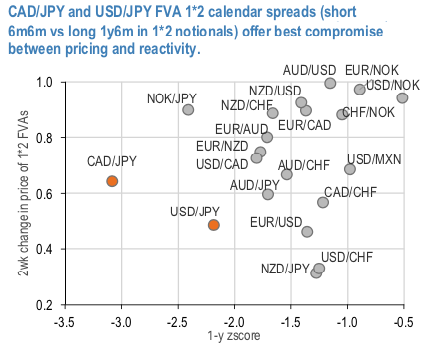

We screen for the FVA spread candidates based on their pricing (in form of a 1-y z-score) and the sensitivity to the ongoing market turbulence (in form of 2-week change in pricing of the package) (refer 1st chart).

In the case of CADJPY the current levels are still a bargain by historical standards, even after the recent bounce. The net 6-month static vol slide (at the expiry of the short leg) deteriorated as the front vols spiked on the back of the recent spot gyrations but is still positive thus making the long/short structure superior to holding a similar long-dated straddle (refer 2nd chart).

Consider: short 6M6M CAD/JPY @8.7ch vs long 1Y6M @8.55/9.05, in 1:2 vega weights or short 6M6M USDJPY @7.6ch vs 1Y6M @7.55/7.95 indic, in 1:2 vega weights. Courtesy: JPM

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different