CADJPY is one of the better candidates since recent CAD weakness has undershot recent moves in oil and rate spreads. But any recovery in crude oil prices may cushion CAD in the upcoming days.

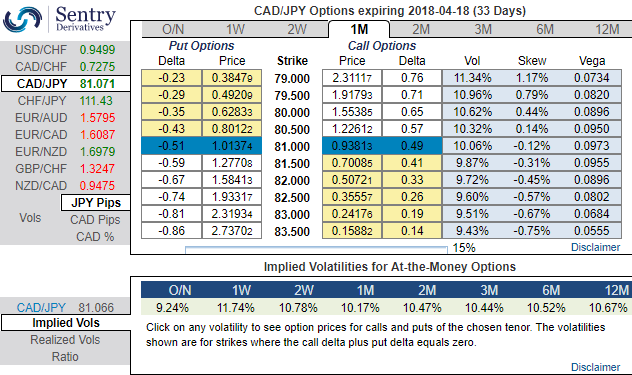

Well, please be noted that the positively skewed ATM IVs of 1m tenors (10.17%) indicate the hedging interests of OTM put strikes upto 79 levels.

On technical grounds, we’ve already stated in our previous post that the current week prices tumbled well below 21EMA levels coupled with flurry of further bearish indications, such as shooting star candlestick pattern (which is bearish in nature), bearish DMA & MACD crossovers, broken wedge baseline with intensified bearish momentum, thereby, one could expect more slumps as both the leading oscillators have been constantly converging downwards to signal weakness. In this process, CADJPY spot FX has tumbled from 91.581 to the current 81.156, more dips seem to be on cards (refer our technical section for more reading).

Well, we reckon that the underlying pair has equal chances of moving on either side but with more potential on the downside, accordingly, we’ve already advocated options strips strategy of narrowed strikes to factor-in all above stated driving forces.

We continue to reiterate it is wise to initiate longs in 2 lots of 1m ATM -0.49 delta puts, simultaneously, add long in 1 lot of +0.51 delta call of 2m expiry, the payoff function of the strategy is likely to derive positive cashflows regardless of swings but more potential from the underlying spot FX moves towards downside.

The risk is limited to the extent of premium paid to buy the options.

The reward is unlimited until the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above -123 levels (highly bearish), while hourly JPY spot index was at 44 (mildly bullish) while articulating (at 07:13 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One