Before beginning with this write-up, we urge you to just glance through the below weblinks where we’ve raised the red-flags recent posts about early signs of CADJPY’s bearishness:

Well, it’s been constant reiteration from us at FxWirePro about the bearish potential in this pair quite often and advocated suitable short hedges accordingly, if you see the current technical charts, the price slumps are evident, it has tumbled into deep tunnels. Rest is history.

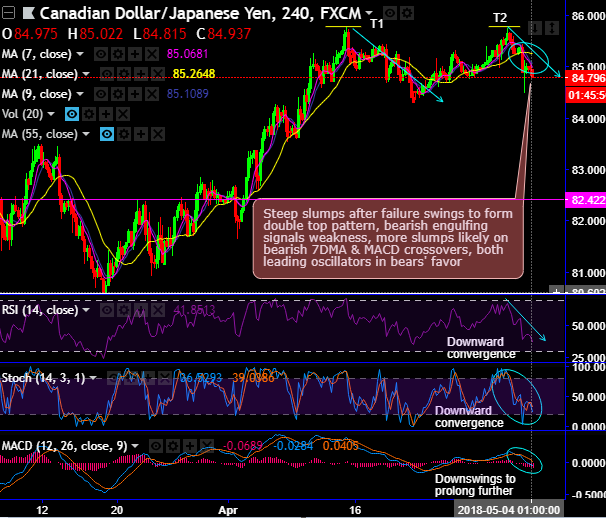

For now, moving on, even the current trend of this pair, steep slumps are expected after failure swings to form the double top pattern as the bearish engulfing pattern candle signals weakness (refer 4H chart).

More slumps seem to be likely on bearish 7DMA and MACD crossovers, this bearish indication is coupled with both the leading oscillators’ bearish indications as they converge downwards to signal extreme weakness.

On the major trend, shooting star followed by engulfing patterns have occurred at 88.649 and 88.112 levels respectively (refer monthly chart).

Needless to say, for now, more slumps seem to be on cards as both DMAs & MACD on daily terms and EMAs on monthly terms show bearish crossovers that indicate the downtrend to prolong further.

Both RSI and stochastic curves on monthly timeframes have constantly been converging downwards to selling interests that confirms the strength and momentum in the bearish trend.

Trade tips: Contemplating both short and intermediate trend observations, it is wise to buy tunnel spreads option strategy with upper strikes at 84.9850 and lower strikes at 84.476 levels, with this leveraged product one can add magnified impact on the trade yields if the underlying spot FX keeps dipping but remains above lower strikes on expiration.

On the other hand, uphold shorts in futures contracts of near-month tenors with a view to arresting further potential slumps.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying shy above 34 levels (mildly bullish), while hourly JPY spot index was at 134 (highly bullish) while articulating (at 07:39 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: