Ichimoku Analysis (4-hour chart)

Tenken-Sen- 88.80

Kijun-Sen- 88.48

Previous Week low-87.18

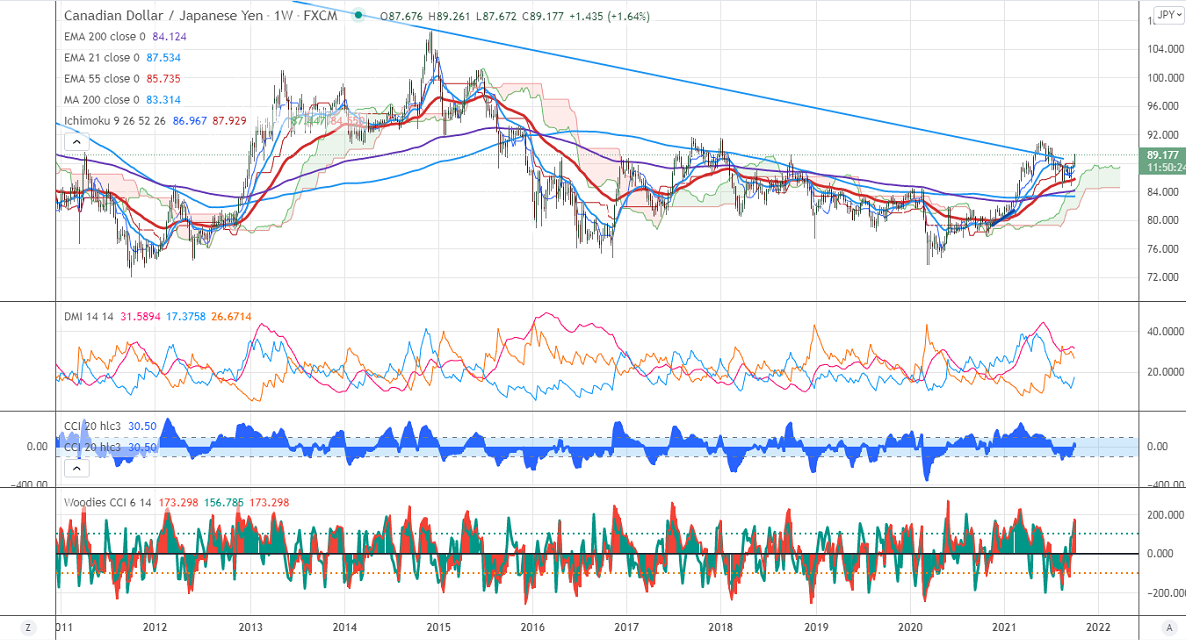

CADJPY is trading higher for the past two weeks and surged more than 400 pips on the strong Canadian dollar. The surge was mainly due to bullish crude oil prices. WTI crude oil prices jumped more than 30% in past six weeks on upbeat market sentiment. The intraday trend of CADJPY is bullish as long as support 88 holds.

USDCAD Analysis-

USDCAD is one of the worst performers this month despite the strong US dollar. Markets eye US and Canadian jobs data which is to be released today for further direction. Any breach below 1.2500 confirms short-term bearishness.

USDJPY-

. USDJPY is holding above 111.50 on risk-on mood and surging US treasury yield. The intraday resistance to watch 112.25. Significant support is around 110.80.

CADJPY-

On the higher side, the pair is facing resistance at 89.25. Any indicative surge past targets 90.10/91.20.

The significant support is at 88.45, any decline below that level will drag the pair down to 88/87.40. Bearish Trend continuation only below 87. A dip to 84.89 is possible.

It is good to buy on dips around 88.70-75 with SL around 87.99 for the TP 91.