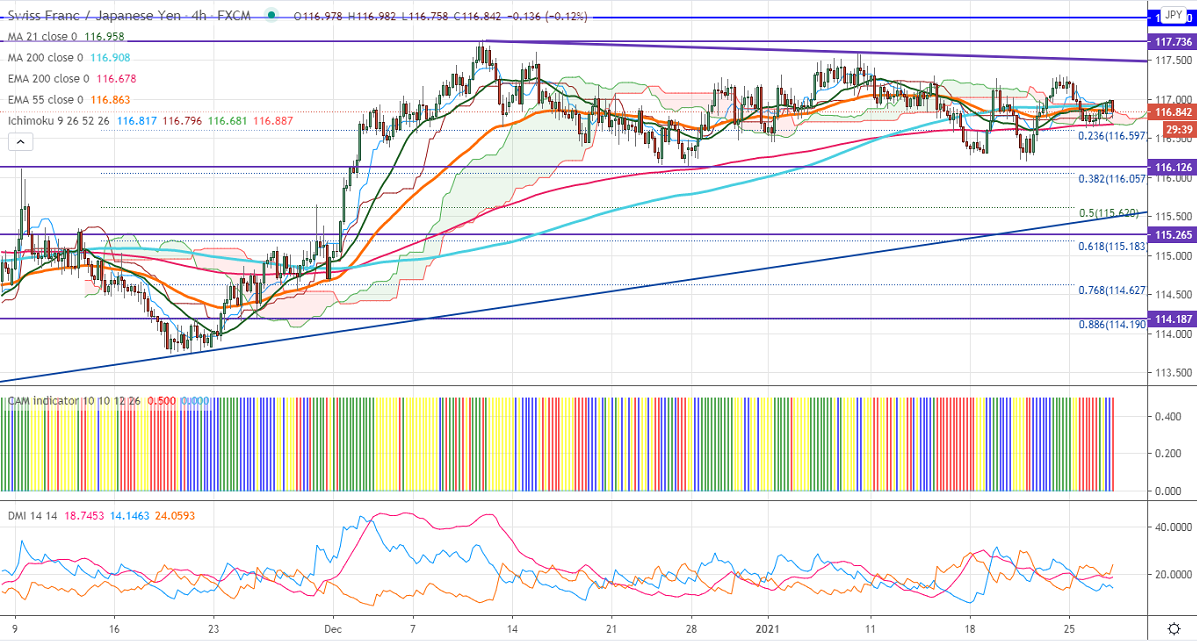

Ichimoku analysis (4-Hour chart)

Tenken-Sen- 116.81

Kijun-Sen- 116.75

CHF/JPY downside capped by 200-4H MA and jumped more than 30 pips on the strong Swiss franc. USDCHF continues to trade flat for the past ten days. Any jump above 0.8925 confirms a bullish continuation. USDJPY is trading directionless, trend continuation only if it breaks 104.40. The intraday trend of CHFJPY remains bullish as long as supports 116.15-20 holds.

Technical:

The pair's strong resistance is at 117.30, violation above will take to the next level 117.60/118.05/118.60. On the lower side, near term support is around 116.90, and any indicative break below targets 116.60/116/115.84.

Indicator (4-hour chart)

CAM indicator –Bearish

Directional movement index –Bearish

It is good to buy on dips around 116.60 with SL around 116.20 for the TP of 118.60.