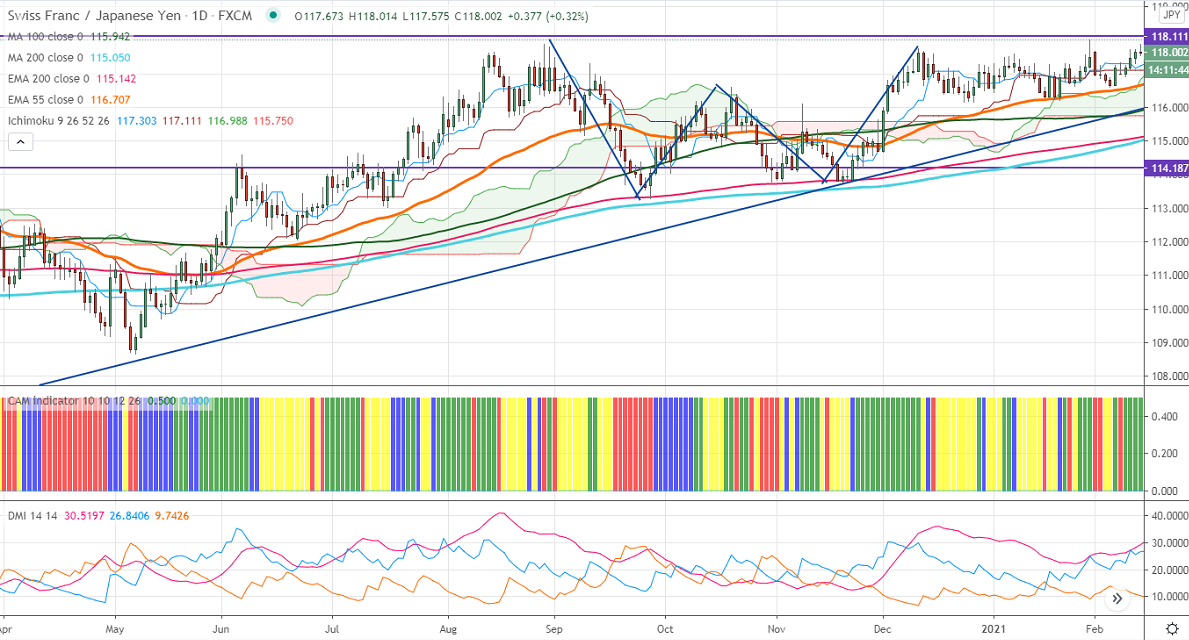

Chart Pattern- Big W

Ichimoku analysis (Daily chart)

Tenken-Sen- 117.24

Kijun-Sen- 117.10

CHF/JPY has formed double bottom around 113.74 and shown a massive recovery on broad-based yen weakness. The upbeat market Sentiment due to coronavirus vaccine progress and hopes for more U.S stimulus has decreased demand for safe-haven. USDJPY is holding well above 105, any violation above 105.78 confirms bullish continuation. The intraday trend of CHFJPY remains bullish as long as support 117.30 holds.

Technical:

The pair's strong resistance is at 118, violation above will take to the next level 118.60/119. On the lower side, near term support is around 117.30, and any indicative break below targets 116.92/116.60/116.

Indicator (Daily chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 117.80 with SL around 117.30 for the TP of 119.