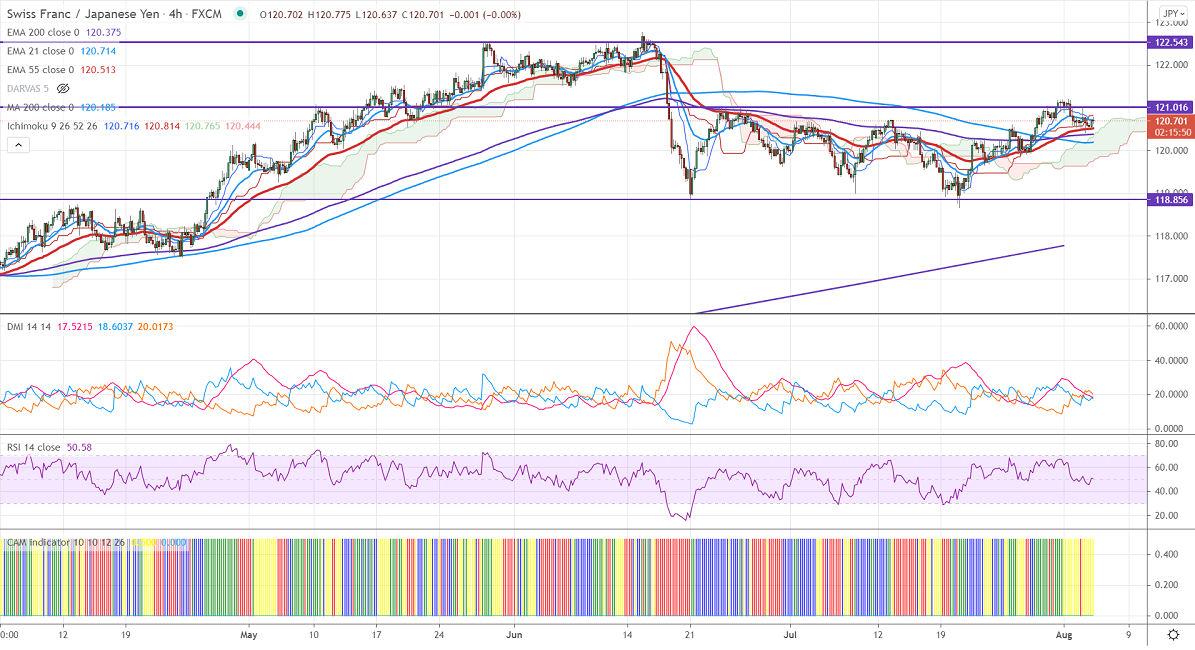

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- 120.71

Kijun-Sen- 120.81

CHFJPY is consolidating in a narrow range between 118.85 and 121.20 for the past two weeks. The jump in Japanese yen due to an increase in demand fr safe-haven assets is preventing the pair from further upside.USDJPY is hovering near 109 levels, any breach below 109 confirms intraday bearishness. USDCHF hits a 7-week low on board-based US dollar selling.CHFJPY hits a high of 120.73 at the time f writing and is currently trading around 120.715.

Technically, near-term support is around 120.40 and any indicative break below will drag the pair down till 120/119.60.

The immediate resistance is at 121.20, any convincing break targets 122/123.

It is good to buy on dips around 120.75-80 with SL around 120.30 for the TP of 122

Resistance

R1- 121.20

R2- 122

R3-123

Support

S1-120.40

S2-119.65

S3-118.65