Intraday trend – Bearish

Major intraday resistance – 126

The pair is trading weak for fourth consecutive days and lost more than 200 pips on board–based weakness in the Swiss franc. The strength in yen due to renewed safe-haven demand puts pressure on the pair at higher levels. It hits an intraday low of 124.82 and is currently trading around 124.835.

Technical analysis-

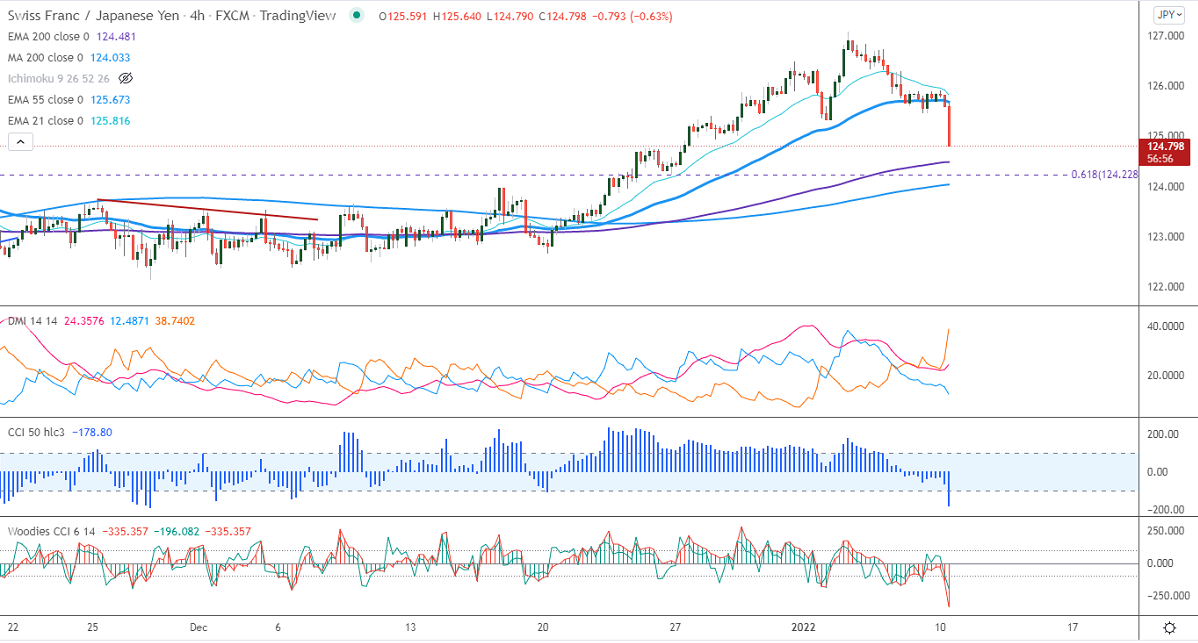

CHFJPY is trading below 21 and 55 EMA (125.705 and 125.914) and slightly above 200-MA and EMA in the 4-hour chart.

The near-term resistance is around 125.35, any breach above targets 126/126.30/127.10. The minor support to be watched is 124.60; the violation below will drag the pair down to 124/123.

Indicators (4-hour chart)

Directional movement index – Bearish

CCI (50) – Bearish

Woodies CCI- Bearish

It is good to sell on rallies 125 with SL around 126 for a TP of 123.