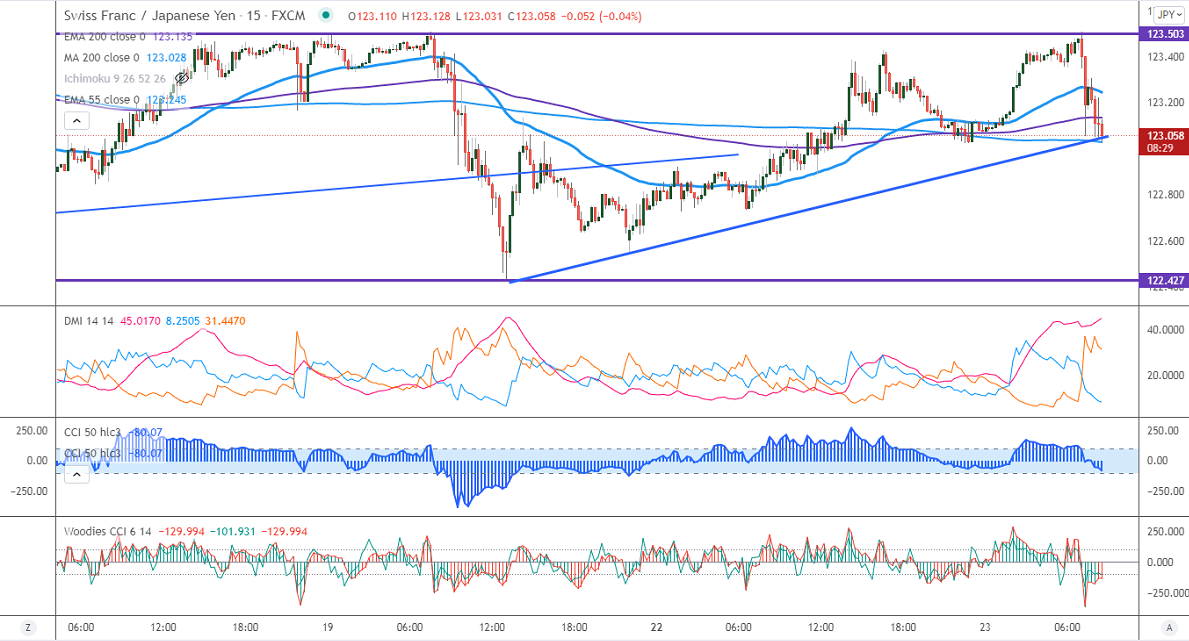

Intraday trend – Bearish

Major intraday resistance – 123.50

The pair has closed above 200-H MA after two weeks of a bearish trend. Any breach above 123.50 confirms further bullishness. A jump till 124/124.49 is possible.

The minor support to be watched is 123, any violation below will drag the pair down till 122.45/121.78 (161.8% fib).

Indicators (15 Min)

Directional movement index – Bearish

CCI (50)- Bearish

It is good to sell on rallies around 123.12-15 with SL around 123.51 for TP of 122.