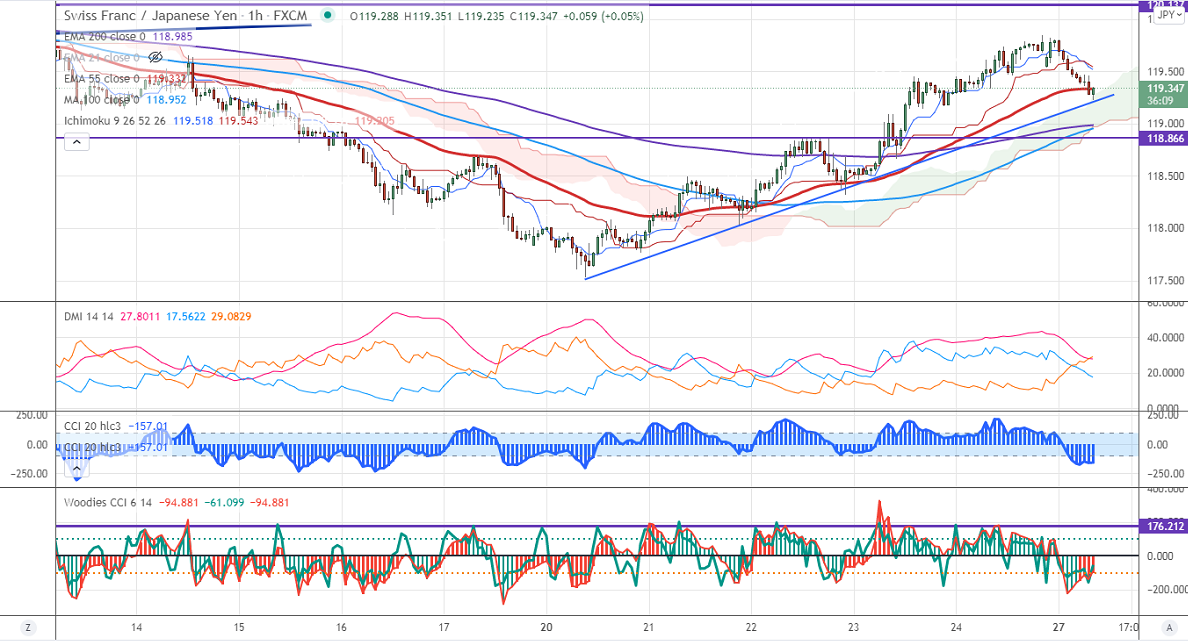

Major Intraday resistance - 119.85

Intraday support- 119

CHFJPY has halted its five days of the bullish trend. The minor weakness in the Swiss franc is putting pressure on this pair at higher levels. The Swiss franc lost more than 80 pips against the US dollar after forming a bottom around 0.92150. Any breach above 0.93250 confirms a further bullish trend. CHFJPY hits an intraday low of 119.23 and is currently trading around 119.281.

CCI and Woodies CCI analysis-

Both CCI (50) and Woodies CCI is below zero lines in 1-hour chart (bearish trend)

In Woodies CCI six consecutive bars below zero line confirms intraday bearishness.

Technically, near-term support is around 119.20 and any indicative break below will drag the pair down till 118.80/ 118.30/118/117.54/117.

The immediate resistance is at 119.85, any convincing break targets 120.10/121.

It is good to buy on dips around 119.10-15 with SL around 118.60 for the TP of 121.