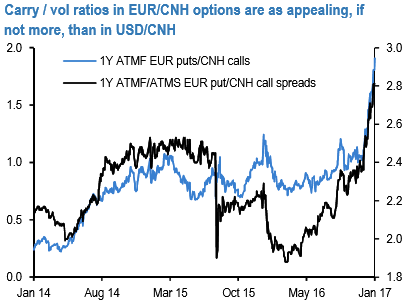

The carry trade looks far more lucrative in a non-dollar CNH cross such as EURCNH. The carry/vol setup is comparable to USDCNH (refer above chart), with the added attraction that the cross is that it is better insulated from dollar gyrations and therefore more liable to deliver positive carry returns.

Recall too that EUR has a substantial 16% weight even in the expanded CFETS basket, so EURCNH is a special cross that can be considered to be the most parsimonious reduced form representation of the basket itself and subject to tight PBoC management; also importantly, one where option markets are somewhat liquid and leveraged carry expressions realistic.

Since the CNY basket has traded largely sideways even through the turbulence unleashed by the US election outcome, it and its proxies such as EURCNH strike us as friendlier animals to bet stability on.

We like to initiate 3M ATMF vs. ATMS EUR put/CNH call vanilla spreads this week to earn carry in the cross, more esoteric expressions can take the form of ITMS EUR put/CNH call at-expiry digitals.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts