How will CNY perform if a trade deal can be reached? It is believed that this is the key question for every market player at this moment. Some would argue CNY could strengthen as the risk sentiment will improve. To be blunt, the so-called "market sentiment" is somehow like my son's mood swings.

Therefore, we can’t only cite “market sentiment” to justify the currency movements. CNY will ultimately depreciate no matter whether a trade deal can be reached. If a deal can be struck, CNY will weaken as China's current account surplus will be shrinking simply because China will have to purchase substantial amount of goods from the US, although the US probably don’t want to see a weaker CNY.

If both sides can't reach an agreement, indicating that the trade tensions are likely to re-escalate, CNY will also depreciate as growth outlook will be gloomier. That said, purely from a trade talk perspective, any constructive view on CNY is still dubious.

Hence, the news that the US canceled the preparatory trade talks, which was later denied by Larry Kudlow, head of the National Economic Council, will only create some market volatility, but won’t change my opinion at all.

OTC FX updates:

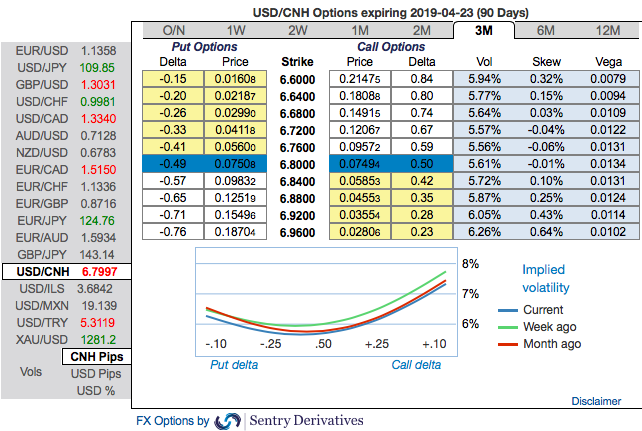

You could easily make out that the positively skewed IVs of USDCNH have been stretched out on either side (refer above nutshell). This is interpreted as the hedgers' bid for both OTM calls and OTM put options.

Trade tips: Contemplating above factors, we advocate buying 7M 40D (6.98 strikes) USD calls/CNH puts vs sell 7M 4.5052 - 5.1658 AUDCNH Strangle. Courtesy: Sentrix & Commerzbank

Currency Strength Index: FxWirePro's hourly CNY spot index is inching towards -77 levels (which is bearish), while hourly USD spot index was at 61 (bullish) while articulating (at 13:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data