The Commitment of Traders (COT) report released by the CFTC has long been signaling that the price of oil could go for a sharp decline as speculators have been reducing their exposure for quite some time now.

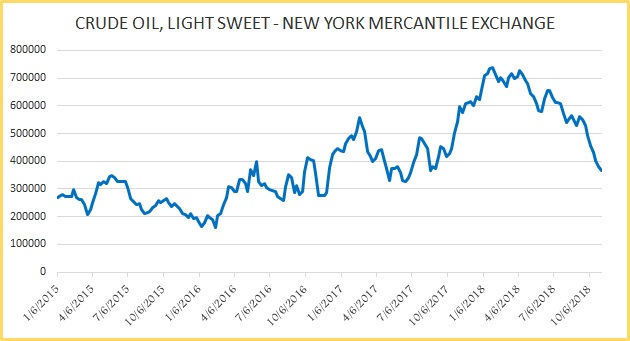

We have been warning that speculative position played a crucial role during the price rise after 2014 slump. So, a reduction in speculative buy position could lead to sharp selloffs in oil price. The chart shows the speculative position in light sweet crude oil. Since April of this year, Speculators have reduced net-long positions from 715.8K contracts to 367.2K contracts as of last week, and more importantly, since September speculators have reduced almost 200,000 contracts of net long positions.

Oil has been rising despite steady decreases in the speculative position since March but finally succumbed to the selling as fundamental also tilted towards short.

The price of crude oil has been declining sharply since October. The global benchmark Brent crude declined from $86.7 in October per barrel to $60.2 per barrel this week

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX