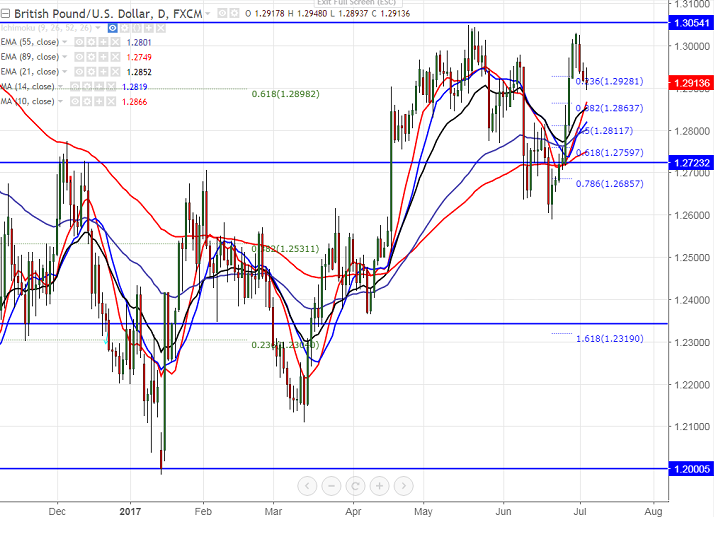

- GBP has shown a major decline after forming a top 1.30297 on Jun 30th 2017 on account weak UK economic data. The pair broken major support at 1.2900 and is currently trading around 1.29109.

- Markit UK services hits four month low at 53.4 compared to forecast of 53.8 on account of political uncertainty. UK manufacturing PMI and construction PMI which also came at slightly weaker than expected.

- The pair should break above 1.3050 for further bullishness. Any violation above 1.3050 will take the pair till 1.3110 (113% retracement of 1.30475 and 1.25894)/1.3150/1.33150 (88.6% retracement of 1.3440 and 1.19040). The minor resistance is around 1.29780/1.3030.

- On the lower side, near term minor support is around 1.2900 and any break below will drag the pair down till 1.2846 (21- day EMA)/1.2810 (daily Kijun-Sen) .

It is good to sell on rallies around 1.2910-1.2915 with SL around 1.2965 for the TP of 1.2845/1.2810.

Resistance

R1-1.2980

R2 -1.3050

R3- 1.3110

Support

S1-1.2840

S2-1.2810

S3-1.2770