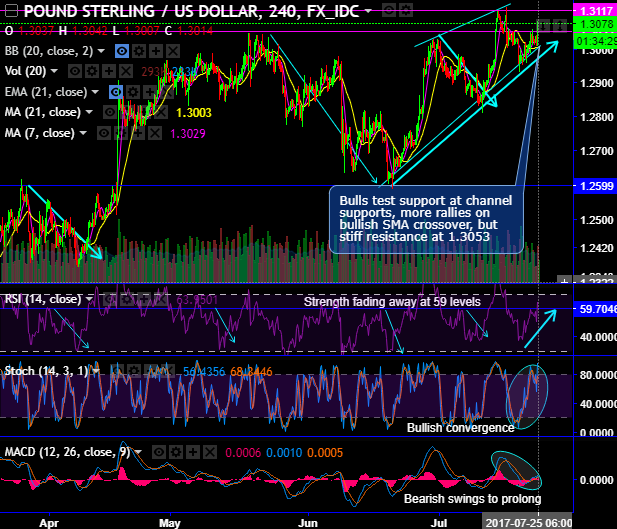

GBPUSD bulls are edging higher at 11-months highs. Bulls test channel supports at 1.3008 levels, more rallies seem to be likely on bullish SMA crossover.

But stiff resistance at 1.3053 is seen which is also broken out decisively, we see next stiff resistance at 1.3120 levels.

On a broader perspective, ever since it has bottomed out at 1.1950 levels and spiked higher above EMAs, the Cable’s consolidation phase seems to be extended.

RSI signals gaining traction in the strength of the upswings of this phase at 50 levels where it has usually shown faded strength historically at that juncture, it was when GBPUSD began drifting in a range (now breached) as shown in the monthly charts.

Both leading oscillators signal the weakness in the current uptrend.

On the other hand, lagging oscillators are also in sync with the same bullish stance offered by the leading indicators. MACD indicates the price rallies to prolong further (both intraday and monthly charts), while 7SMA has crossed above 21SMA which is again a bullish signal.

Overall, the consolidation phase gains more upside traction having no big and significant data event to disrupt this sentiment in the near run, but the major trend is restrained below 21-EMA, whereas interim rallies are also backed decisively by both leading & lagging indicators.

Trade tips:

Well, as a result of above technical reasoning, on speculative grounds we advise boundary binaries.

Use upper strikes at 1.3120 and lower strikes at 1.3050, thereby, this strategy is speculating around 45 pips on the upside and 25-30 pips on the downside.

The strategy is likely to fetch leveraged yields as long as underlying spot FX remains within these strikes on or before the binary expiry duration.

While the FxWirePro currency strength index for the dollar amid tepid day as there is no significant data announcement for the day is indicating extreme weakness relinquishing its yesterday’s stiffness to the bears (-150 highly bearish), while GBP has been highly bullish by flashing 168.

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate