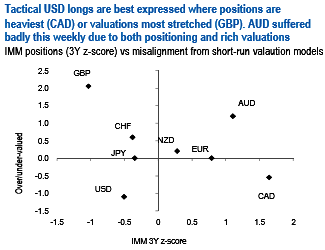

Cable is the most over-valued G10 currency versus the dollar (refer above chart). Indeed, cable is more expensive versus 2Y rate spreads than at any point in the last five years. Fair-value currently languishes at 1.15, more than two sigma below the spot rate (refer above chart).

GBP is consequently one of the most attractive currencies to sell for an extension of the dollar’s interest rate rally. There is also a strong domestic case to re-sell GBP insofar as:

1) The economy is now more clearly slowing in response to an inflation drag on consumption and underlying business caution due to Brexit. Growth in Q1’17 is expected to be only half the 2.9% recorded in Q4’16. High hopes for BoE rate hikes this year have been crushed.

2) The government is on course to trigger Article 50 by the middle of the month despite a setback in the House of Lords for its enabling legislation Q1 over Article50. Investor confidence is vulnerable as it should become apparent relatively early into the formal negotiations that the UK is on course for a harder Brexit with all of the economic disruption that leaving the single market is likely to entail.

3) The Scottish National Party is expected to argue at its conference on March 18-19 that a second referendum on independence should be held. The UK government is expected to resist such a call for now, but investors will be reminded that the break-up of the UK is a high-probability consequence of the UK’s decision to leave the EU.

The main risk to a cable short comes from a downgrade of European political risk and a consequent squeeze higher in EURUSD, albeit EURGBP would take up quite a bit of the slack of a resurgent EUR.

Sell GBPUSD at 1.2150, stop at 1.2530.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand