Bearish GBPUSD scenarios:

1) No-Brexit deal.

2) The BoE passes in Aug, possibly due to political turmoil.

3) May is challenged and replaced by a hard-Brexiteer.

4) The overt balance of payments pressure.

OTC outlook:

Please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 1.3050 levels (above nutshell). While bearish neutral delta risk reversal indicates that the hedging activities for the downside risks remain intact.

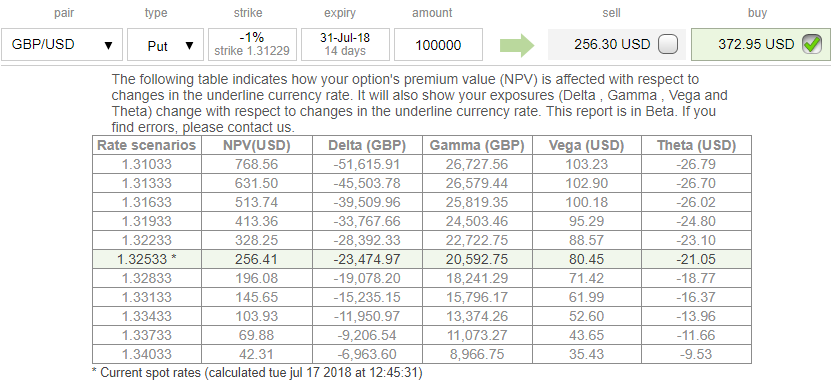

Amid this hedging outlook, 1% out-of-the-money GBP puts of 2w tenors seem to have been exorbitantly overpriced. As you could observe from the above nutshell 2w OTM puts are priced 45% more than that of its NPV (net present value), whereas, 2w implied volatilities of this pair is just shy above 7.40%. Hence, it is perceived as the disparity between IVs and the pricing of optionality.

We wish to square-off reverse knock-out (RKO) spread that was advocated earlier, refer below weblink: https://www.econotimes.com/FxWirePro-Smart-approach-of-tackling-bearish-GBP-Revolve-spot-trades-from-Cable-and-GBP-JPY-into-EUR-GBP-and-GBP-CHF-1397900

While contemplating above OTC bids, put ratio back spreads are advocated, wherein short leg is most likely to function if the prevailing rallies of the underlying spot FX continue or remain above from the spot levels, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging, more number of longs comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, initiate longs in 2 lots of longs in 1m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -13 levels (which is bearish), while hourly USD spot index was at -129 (bearish) while articulating (at 07:31 GMT). For more details on the index, please refer below weblink:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis