In February this year, we called on our readers go short on Hong Kong’s benchmark Hang Seng index as problems continued to mount of the economy, especially due to the higher interest rate in the United States and U.S. trade war against China, https://www.econotimes.com/FxWirePro-Sell-Hang-Seng-index-targeting-at-least-10-percent-decline-1166498 . Recently, Societe general published a report suggesting Hong Kong is currently the most vulnerable economy.

Since Hong Kong dollar is pegged to the USD, Hong Kong Monetary Authority (HKMA) raises the interest rates along with the U.S. Federal Reserve in order to keep the peg stable. Since December 2015, HKMA has raised interest rates seven times with the last one being in this month. Hong Kong dollar (HKD) is allowed to float between 7.75 and 7.85 per USD and it is important to note that the HKD is trading at the lower range of the peg around 7.85 per USD since March this year. In a separate article, here, https://www.econotimes.com/Sniffing-a-peg-break-Series-HKD-might-suffer-temporary-breach-in-peg-1265373 we suggested that the HKD peg might break temporarily with a drop to 7.96 per USD.

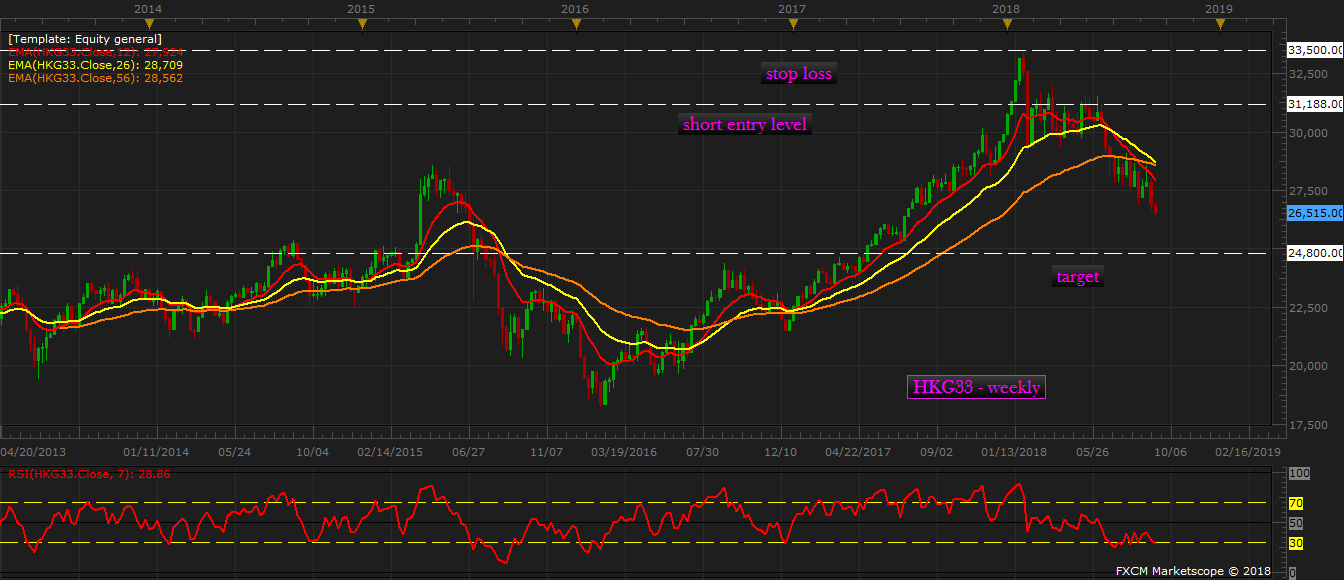

In a follow-up review to the call, we extended our target for the Hang Seng index to 25500 area and in a separate review last week, we have urged readers to add fresh short positions in Hang Seng or HKG33 (CFD of Hang Seng).

Today, Hong Kong’s benchmark index has declined to 26400 (HKG33) area, which is the lowest level for the index since July last year. Our latest calculations suggest that while 25500 area is our forecasted target, the momentum is likely to push the index beyond our forecasted target and towards 24800 area.

Hence we would urge readers to maintain short positions.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed