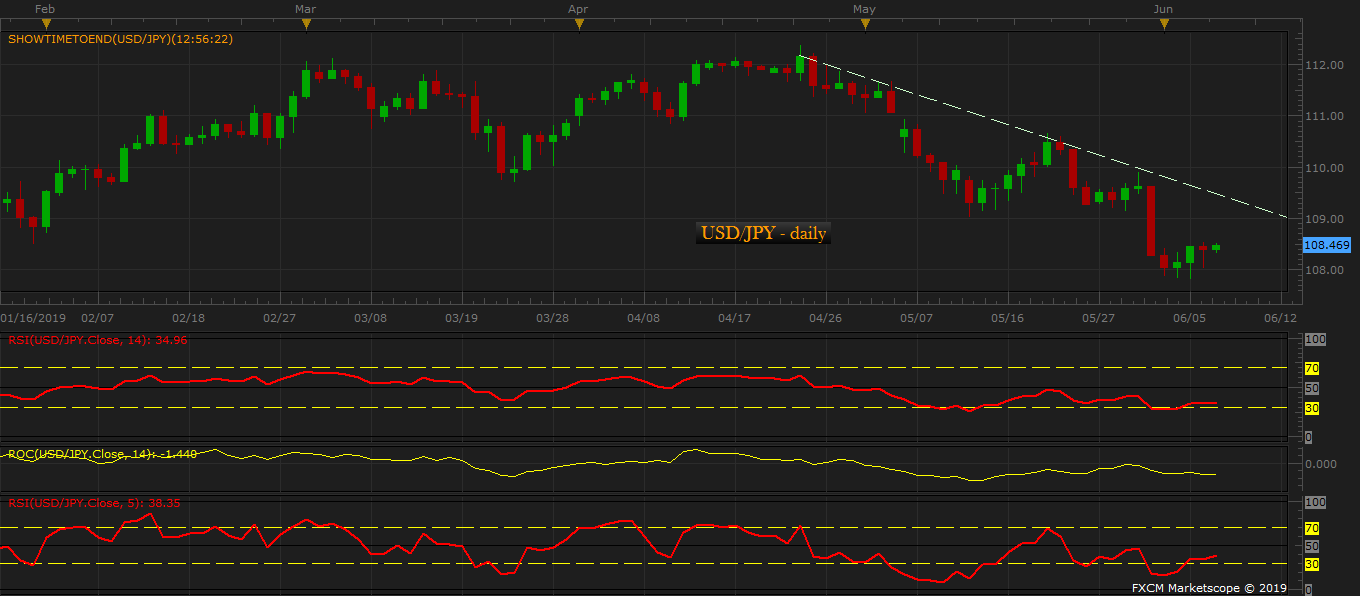

Last week, we warned our readers that while the risk-affinity has gathered some momentum and the yen is retreating towards 110 per USD after reaching 109.1 per USD area, that the yen is likely to gain further grounds against the USD amid risk aversion.

Any relief a relief is only temporary as risk aversion is likely to return as no material progress has been made with regard to Sino-American trade negotiations with both sides preparing measures that would push the conflict to the next level. The United States is preparing grounds to impose 25 percent tariffs on $300 billion worth of goods from China. China, on the other hand, planning to use rare earth minerals, which are essential for industries like information technology to automotive as a tool in its tariff war with the United States. China is the single biggest producer and exporter of rare earth minerals and U.S. depends heavily on China which is the source of 59 percent of U.S. imports. China is also considering steps to toughen to do business for U.S. firms in China.

During his visit to Europe to commemorate the 75th anniversary of the D-day, President Trump announced that additional 25 percent tariff decision would be taken after the G20 meeting to be held later this month after his meeting with President Xi Jinping.

As expected, the yen has indeed gained further grounds and currently trading at 108.2 per USD and we have forecasted 106.7 area as the next target for USD/JPY. We have extended that target to 104 area in the last review.

Trade idea:

- FxWirePro’s latest calculations suggest that USD/JPY is likely to correct towards 109.2 area and we would recommend selling at correction with the above-mentioned targets.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed