Despite strong manufacturing growth across most of the CEE, inflationary pressures are not emerging yet. Most of the headline CPI acceleration we have witnessed has been driven by large commodity price swings acting on top of a low base. Underlying core inflation dynamics remain stable.

This was once again highlighted by Czech import price data and Polish wage data yesterday. The latter has recorded 4%-plus year-on-year increase during all months this year, but as usual year-on-year growth numbers can include misleading base effects. Seasonally adjusted wages fell by 0.3% m/m in April after increasing by 1.5% in March.

In other words, April was a weak month for wage growth and this will likely impact household consumption. When extrapolating recent economic strength indefinitely into the future, this is precisely the kind of reversal the market should guard against.

We see NBP remaining dovish, and forecast EUR-PLN to reach 4.25 by the end of Q2.

One recent positive development is that compulsory FX mortgage conversion now seems unlikely.

Zloty support from interest rates is limited from current levels, with the market pricing rate hikes in line with JPMorgan's economists over the next 2 years.

Trading tips:

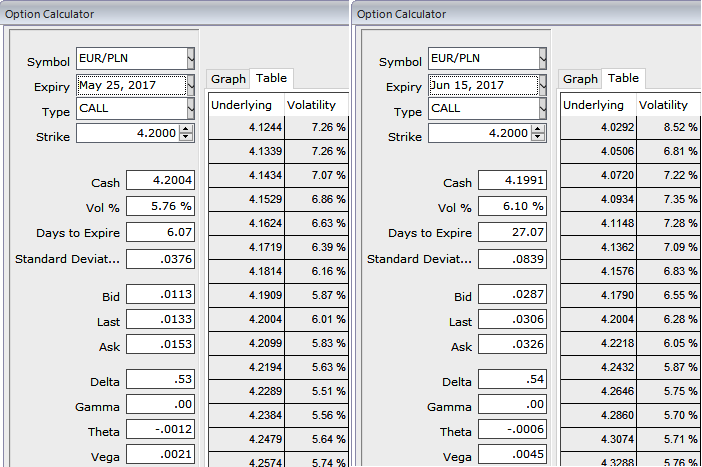

Please be noted that the ATM IVs of EURPLN is at shy above 5.75% and at 6.10% for 1w and 1m tenors respectively.

At spot ref: 4.2024, we advocate entering a new EURPLN 1m2m diagonal call spread (4.2235/4.1518). The underlying spot FX trend and IVs are favorable to write ITM calls.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms