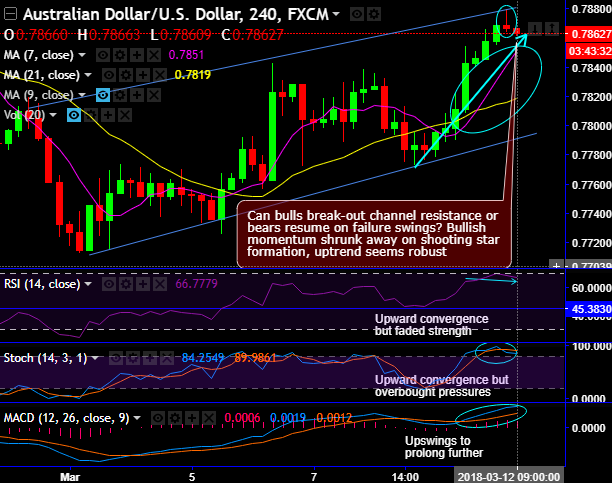

AUDUSD chart and candlestick pattern formed: Minor trend spikes through rising channel, shooting star candlestick has occurred exactly at channel resistance of 0.7866 levels on intraday chart (refer 4H chart), Thereby, the bullish momentum is shrunk away on this bearish pattern that has currently evidenced considerable price slumps from the peaks of 0.7879 to the current 0.7863 levels.

On the flip side, the intermediate trend has also been spiking through rising channel pattern (refer weekly plotting), a potential double top pattern has occurred on this timeframe.

Can bulls break-out channel resistance or bears resume on failure swings is the most dubious question for now.

The bearish patterns (shooting stars, failure swings at channel resistance and double top) are coupled with the RSI and stochastic curves’ downward convergence that signals overbought pressures.

Although mild rallies are observed this week, bullish interests are not backed by momentum indicators that signals continued weakness.

On a broader perspective, the pair has been going through consolidation phase after a massive downtrend, where a potential double top formation seems to be most likely with top 1 at 0.8125 and top 2 at 0.8135 levels. Although this pattern is bearish in nature, still the major trend goes non-directional (refer weekly plotting).

Both leading oscillators (RSI & Stochastic) have been showing downward convergence, momentum seems to be little edgy for now on weekly terms, hence, ongoing rallies are quite dubious.

Trade tips: Well, on trading perspective, at spot reference: 0.7863, it is advisable to buy boundary binary strategy using upper strikes at 0.7879 and lower strikes at 0.7843 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps dipping but remain within these strikes on or before the binary expiry duration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 0.75 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 57 levels (which is bullish), while hourly USD spot index was at -11 (bearish) while articulating (at 09:36 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: