More positive market sentiment is weighing on the Japanese yen, which as a result is less in demand as a safe haven. However, the monetary policy outlook suggests that the appreciation trend of the Japanese currency is not yet over. USDJPY has been trading in sideway trend today (at 109.620 levels) so far.

The JPY has been one of the outperformers this year so far. The initial reason for the yen's strength was fears of a global recession that had arisen recently which fuelled demand for the Japanese currency as a safe haven. We ruled out slow normalization of monetary policy, as inflation in Japan has so far made no attempt to approach the BoJ's 2% inflation target.

The BoJ is no longer expected to raise the yield target in 2020 given the downgraded inflation outlook.

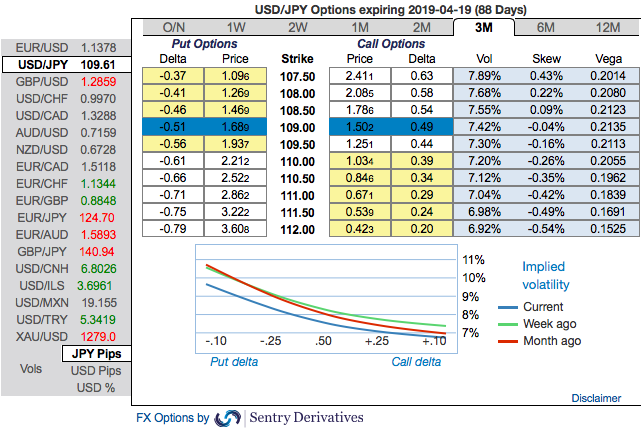

USDJPY OTC update is as follows:

You can observe the positive shift in bearish risk reversal numbers of USDJPY across 1-3m tenors is also substantiating downside risks amid momentary upswings in the short-run.

Most importantly, please be noted that the positively skewed IVs of 1m tenors are still signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 107.50 levels so that OTM instruments would expire in-the-money.

OTC positions of noteworthy size in the forex options market can stimulate on the underlying forex spot rate. The Market Pin Risk report shows large options expiring in the next 5 days. Red strikes indicate sizeable open interest close to the current forex spot rate. FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices (in this case, USDJPY has the highest interest towards forward point at 111.50). The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta, compare spot and risk reversal curves that evidence the same.

Accordingly, a couple of days ago the debit put spreads have been advocated, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 109.602 levels, buy a 1M/1w 111.50/107.50 put spread (vols 7.60 vs 7.58 choice), wherein short leg is likely to function as the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. Courtesy: Sentric, Saxo and JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at -50 levels (which is bearish), while hourly USD spot index was at 52 (bullish) while articulating at (11:35 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks