OPEC’s call to action supports prices in the face of materially weaker fundamentals:

Last week’s extraordinary meeting of the OPEC conference in Algiers concluded with a commitment to change OPEC’s production strategy and cap production at between 32.5-33.0 mbd.

We expect the commitment to cut production to be honoured at November’s OPEC meeting with an agreement that fleshes out the details.

Re-establishing price leadership shifts the balance of risks for oil prices higher over the coming quarters. This shift in OPEC strategy continues to cushion oil prices.

Crude futures for November delivery attempt to break above $50 resistance levels today, as the EIA report showed crude inventories declining. Crude oil inventories declined 2.976 million barrels which is lower than the expected build of 1.5 million barrels and confirming the larger API report’s drawdown (drawdown of 7.6 million barrels) from Tuesday.

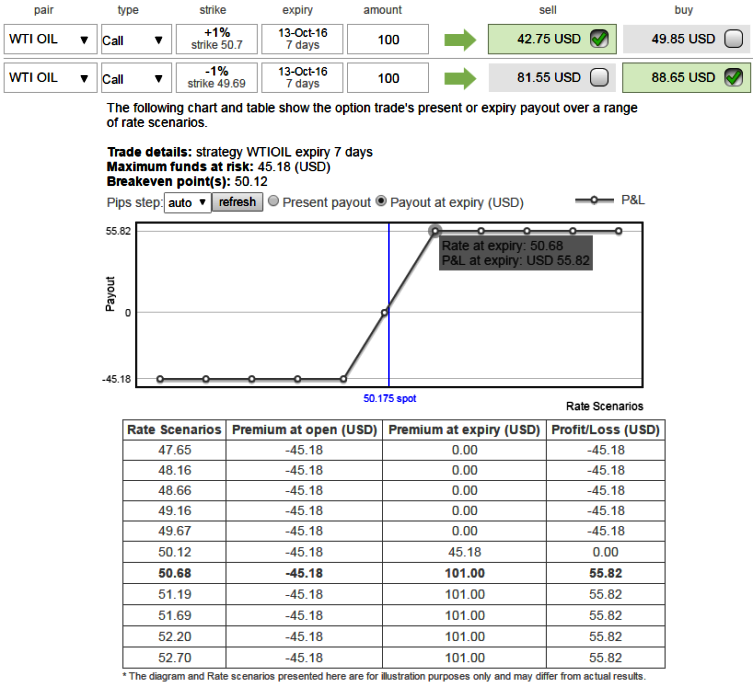

Hedging Strategy:

Favour optionality to directional trades. We are inclined to position for a partial retracement of the down move through call spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Call spreads are preferred to vanilla structures given elevated skew and favourable cost reduction.

Buy 1w call spread with strikes of 53.15- 47.18 for a net debit.

Up to a certain spot price, the bull call spread works a lot like its long call component would as a standalone strategy.

However, unlike with a vanilla long call, the upside potential is capped. That is part of the tradeoff; the short call premium mitigates the overall cost of the strategy but also sets a ceiling on the profits.

Please be noted that the strikes shown in the diagram are just for the demonstration purpose only, payoff resemble any vertical spreads.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX