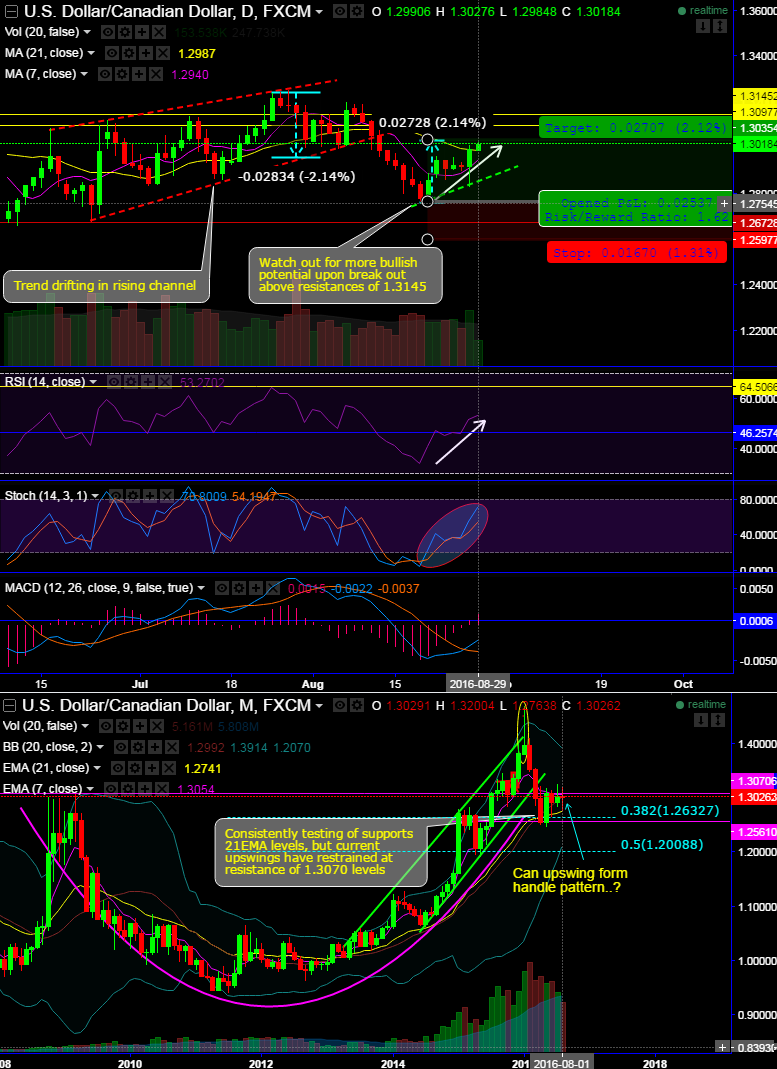

Dear readers, the moment when the pair has broken the baseline of rising channel, it has travelled equidistance southwards (about 2.14%).

USDCAD clears 1.2950 resistances with the break to two-week highs.

Watch out for more bullish potential upon break out above resistances of 1.3145.

It appears to be the CAD taking a halt from its intermediary bull run against USD (see both daily and monthly plotting).

Upswings in USDCAD spiked above DMAs but testing resistance at 1.3035 levels, the break above exposes more upside potential, else bears have equal chances.

Both leading oscillators signal buying interests, as RSI (14) evidences a bullish convergence with the spiking price nearly from the oversold region, currently trending upwards at above 53 levels, so we believe there has been buying sentiments atleast in the short run.

While the clear bullish crossover on stochastic again from the oversold region also signals momentum in this buying sentiment.

On a broader perspective, the pair has dipped from the highs of 1.4689 levels to the current 1.2460 (i.e. almost more than 38.2% Fibonacci retracements) within a span of 4 and half months. But for now, jumped above from that level and been consistently testing of supports 21EMA levels, but current upswings have restrained at the resistance of 1.3070 levels.

If the prevailing rallies continue to persist for few weeks then we could foresee handle pattern in coming months. So we’ve cautiously been watching on the decisive break out above resistance at 1.2859 levels on closing basis.

Hence, the short-term bullish opportunities upon any break above 1.3035 levels are encouraged at the current juncture.

Trade tips:

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.2988 > Fwd price > 1.3035).