The GBP depreciation seen over the past months is a double-edged sword. Sterling has depreciated by more than 15% on a trade-weighted basis since the Brexit referendum. That is having a positive effect on the economy as a possible fall in investments can be counterbalanced by higher exports. However, Sterling’s momentum is having a price effect in both directions.

Due to higher import prices, a weak Sterling is going to put pressure on British consumers at some point. Today attention focuses on how notably and how quickly Sterling’s losses would be reflected in inflation: the price data for September is due for publication.

However, it seems unlikely that a surprisingly high inflation will have notable effects on monetary policy and therefore Sterling.

BoE governor Mark Carney has already suggested that he would accept inflation overshooting. At present, the BoE is focussing on supporting the economy. And following positive economic data market participants do not expect the BoE to cut interest rates again in November.

We assume that the BoE would keep its powder dry so as to be able to react with further rate cuts should the economy deteriorate in the future.

For the time being speculation about the when and how of Brexit remains the dominating factor for GBP exchange rates.

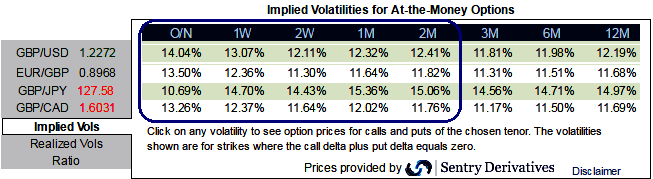

Now, let's glance through the sterling's implied volatility across 1w-2m tenors ahead of ECB's meeting.

The GBP crosses are likely to perceive increasingly higher IVs for ATM contracts especially in 2m expiries that encompass the major macroeconomic fundamental events.

You can also observe from the nutshell, the same vols of these contracts have been shrinking away thereafter.

You know to interpret the options with HY IVs cost more and this is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. When these IVs keep spiking higher and you are holding an option, which is a conducive opportunity for the holder of the option. Conversely, if you are writing an option and underlying spot FX goes against your anticipation it would be extremely risky.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX