China’s official Xinhua News Agency confirmed that Kim Jong Un finished a 3-day visit to China today, ending a few days of guesswork by the international media. The first foreign trip since Mr.

Kim took power in December 2011, taking place just before the summit between the US and North Korea, clearly signals that China won’t be left out on the sideline in the Korean Peninsula affairs.

This obviously will confound the trade conflict with the US, exactly in line with what a few economists pondered out last week: It’s not (only) the economy. In the meantime, China has reportedly begun to study some measures, including lowering the tariffs on consumer goods, increasing imports and reducing the trade surplus. You may have this kind of experience:

All the luxury goods and IT shops in the airports are packed with Chinese tourists, and the only reason is that these goods are much more expensive in China because of high tariffs. So if Mr. Trump manages China to lower their tariffs, there could be fewer Chinese tourists in the shopping malls, and we will have better shopping experiences as well.

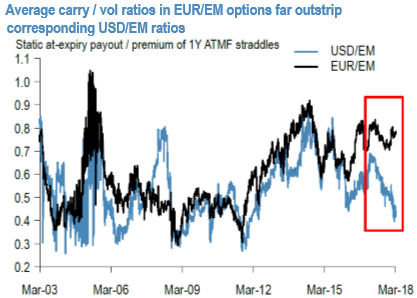

If the forward points vs. vol disconnect is noteworthy in EURUSD, it is even more acute in EUR/EM crosses, where carry/vol ratios have long provided a reliable steer on the vol stance. Much like EURUSD, aggregate carry/vol ratios in EUR/EM vols have reached stratospheric levels in sharp contrast to their USD/EM brethren, where carry has gotten squeezed due to the rise in U.S. short-end rates (refer 1st chart), except that absolute magnitudes are far more pronounced than in thinner-carry G10 currency pairs.

Spot out this divergence between USD-pairs and EUR-crosses which is a pan-EM phenomenon and is most acute in the likes of CNH, BRL and RUB (refer 2nd chart); these are all currencies that appear to be constructive; hence, there is a decent case to be made for exploiting cheap option pricing to strap on carry exposure in their EUR-crosses (i.e., play offense by using cheap vol to own carry), which also has the happy side effect of providing a fair degree of insulation to broad dollar trends. We have been running long ATMF vs. ATMS put spreads in both EURCNH and EURRUB since the last Q4, and both still count as solid buys; the further out one can go in tenor, more attractive the trade optics, liquidity permitting, of course.

Given the weight of long positions in both CNH and RUB, we are not averse to fresh carry structures taking the form of 1*2 ratio EUR put spreads that over-sell the out-of-the-money strike, e.g., EURCNH 6M 7.95 / 7.75 1*2 put spreads cost 25bp in premium (spot ref. 7.7312, 6M fwd ref. 7.9613) and offer a max gearing of 6.6 times.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures