As the People’s Bank of China (PBoC) taking up steps to ease the capital crunch in its financial system by reducing reserve requirements, easing lending rules designed carefully without a broad-based rate cut, the short-term rates in China are finally declining both in the government and corporate bond markets, as China has been suffering billions of dollars’ worth of corporate defaults this year. The latest move freed up almost 1.2 trillion yuan ($174.72 billion) in total. Of that, 450 billion yuan ($65.52 billion) will be for banks to repay short-term debt coming due this month and 750 billion yuan will be released into the financial market.

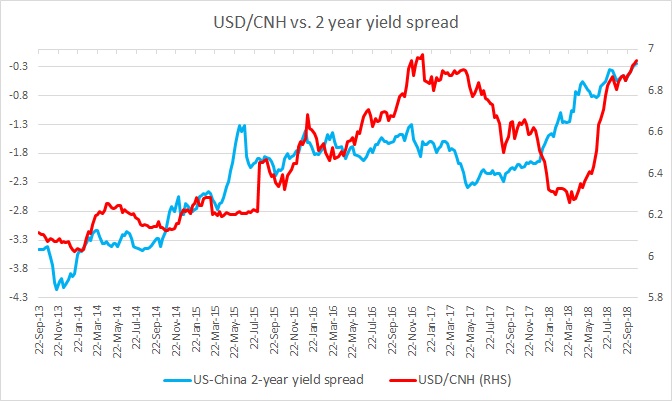

As a result of the PBoC’s actions over the past month or so has pushed the 2-year government yield declined by 22 bps since mid-September to 312 bps as of today. This is the lowest level for the yield since August.

As the yield declines in the mainland, the rate differential with the U.S. counterpart (2-yr treasury) is once again rising in favor of the USD, and as a result of that, the USD has started rising against the yuan. Our calculations suggest that as the U.S. Federal Reserve is set to continue raising rates, yuan is set to weaken past 7 per USD and reach as low as 7.05 per USD in the short to medium term.

The last time, the yuan tried to breach the 7 per dollar mark was back in December 2016 and almost after two years, the yuan is trading at the lowest level since then. It is currently at 6.95 per USD.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX