The weakness in Turkish assets accelerated over the past week. The lira has weakened by around 2% against the US dollar since the start of November, underperforming other EM currencies (refer above chart). The underperformance has been driven in part by a worse-than-expected CPI inflation.

We are UW both duration and FX in Turkey in the GBI-EM Model Portfolio, with a preference for FX UWs. We believe there is a good case to enter fresh bearish positions in both local bonds and the currency at current levels.

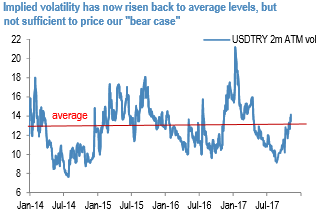

We have a preference for entering bearish positions in the currency, as the CBRT is likely to only hike rates in response to currency weakness, and hence, we keep a larger FX UW relative to duration. In outright trades, we recommend buying a 2m 4.10 USDTRY call. The option market has so far priced in only a moderate deterioration in the outlook for lira with close to average levels of implied volatility and skew (refer above charts).

However, as we are in our view now transitioning towards our “bear case” scenario of an increasingly negative feedback loop between the currency, asset prices, and outflows, we can envisage a much more fragile pattern before the central bank is forced to step-in a credible manner. The situation is likely to be exacerbated by negative current account seasonality in December and low liquidity around the year-end.

We, therefore, recommend buying a 2m USDTRY 4.10 call indicatively priced at 1.26% (spot ref. 3.8850) to take advantage of the likely rise in volatility and skew as USDTRY trades higher. The risk on the trade is limited to the premium paid. Courtesy: JPM

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close