Gold -

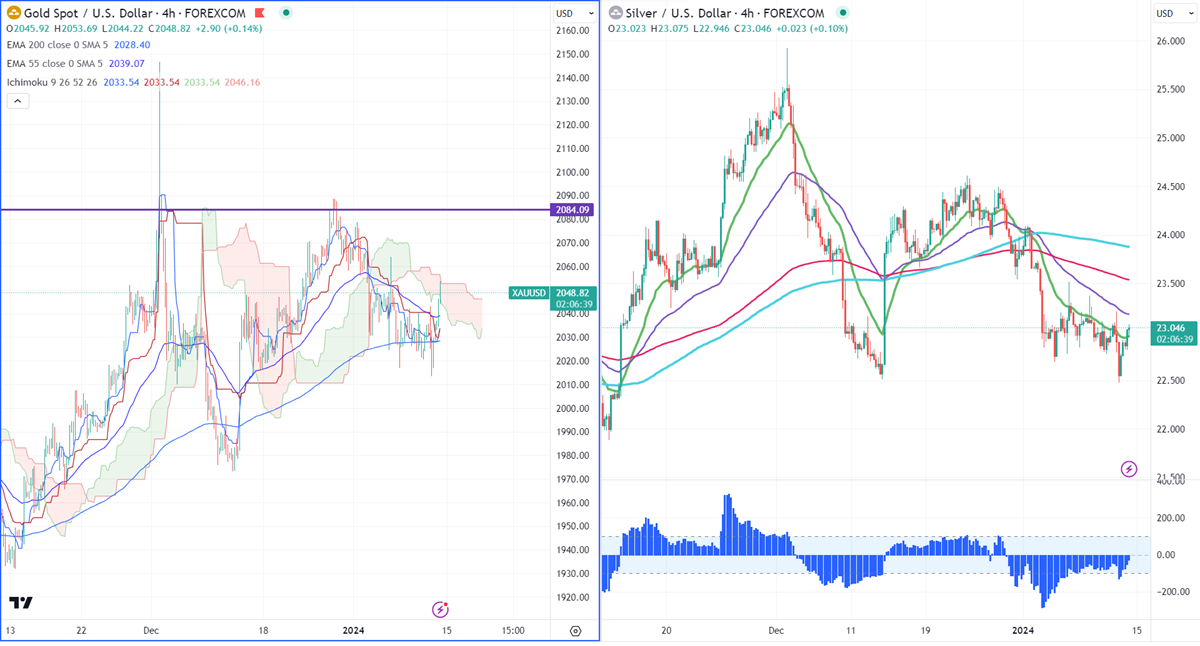

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2029.78

Kijun-Sen- $2029.78

Gold showed a nice pullback despite strong US CPI data. US headline CPI rose to 3.4% YoY, compared to a forecast of 3.2%. Annual core CPI increased 3.9% from 4% in November. It hit a low of $2013.39 and is currently trading around $2040.55.

According to the CME Fed watch tool, the probability of a no-rate cut in Jan increased to 95.3% from 93.80% a week ago.

US dollar index- Neutral. Minor support around 101.80/100.60 The near-term resistance is 103/104.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - neutral (mixed for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $2035, a break below targets of $2024/$2010/$2000. The yellow metal faces minor resistance around $2050 and a breach above will take it to the next level of$2060/$2070/ $2090/$2100/$2150.

It is good to buy on dips around $2030 with SL around $2010 for TP of $2150.

Silver-

Silver showed a false break out below $22.50 and jumped more than 2% following the footsteps of Gold. The precious metal trades below 21 and 55- EMA and long-term MA (200- MA) in the 4-hour chart. Any break above $23.20 (200-4H EMA) confirms minor bullishness. A jump to $23.60/$24/$24.50. It is facing significant support at $22.50 Any close below $22.50 targets $21.80/$21.

Crude oil-

WTI crude oil prices gained sharply on Middle East tension escalation. According to Bloomberg reports, $110/$130 call option spreads of about 30 million barrels worth of Brent Crude oil have traded in recent days.

Major resistance- $75.35/80. Significant support- $71/$68.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand