Gold -

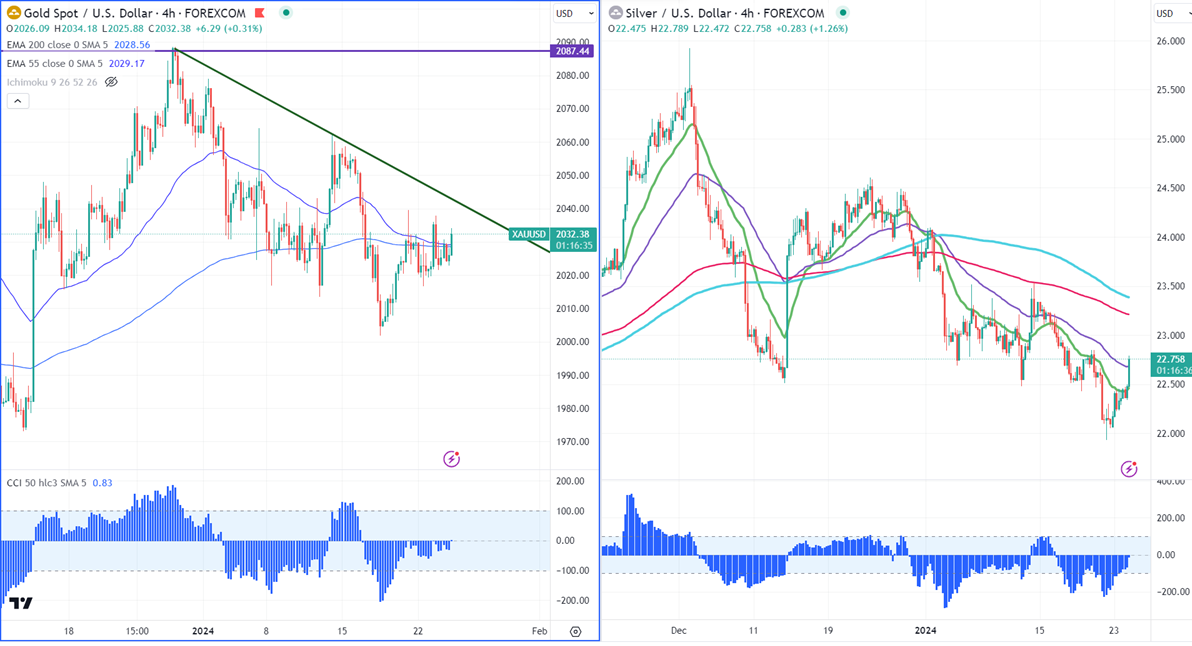

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2028.54

Kijun-Sen- $2022.68

Gold has traded in a narrow range of $2039.48 and $2016 for the past three days. US Richmond fed manufacturing index dropped to -15 vs. Expected -8. The yellow metal hit a high of $2039.48 and is currently trading around $2030.75.

According to the CME Fed watch tool, the probability of a no-rate cut in Jan decreased to 96.90% from 97.90% a day ago.

US dollar index- Bullish. Minor support around 103/102.40 The near-term resistance is 103.75/104.50.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bullish (Bearish for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2000, a break below targets of $1970/$1956. The yellow metal faces minor resistance around $2040 and a breach above will take it to the next level of $2050/$2062/$2078.

It is good to buy on dips around $2015-16 with SL around $1998 for TP of $2065/$2080.

.

Silver-

Silver is trading higher for the second consecutive day after a massive sell-off. The minor decline in the US dollar index supports the silver price at lower levels. It trades below 21 and 55- EMA and long-term MA (200- MA) in the 4-hour chart. Any break below $21.90 confirms a bearish continuation. A decline to $20.68/$19.90 is possible. It is facing immediate resistance around $22.85. Any break above targets $23.55/$24.

Crude oil-

WTI crude oil prices gained momentum on US production outage and escalation of tension in the Middle -East. Markets eye EIA crude oil inventory.

Major resistance- $75.5/80. Significant support- $70/$68

Economic calendar

Economic calendar

Jan 24th, 2024 US Flash manufacturing PMI (2:45 pm GMT)

BOC monetary policy and US Flash manufacturing PMI (2:45 pm GMT)

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data