Gold -

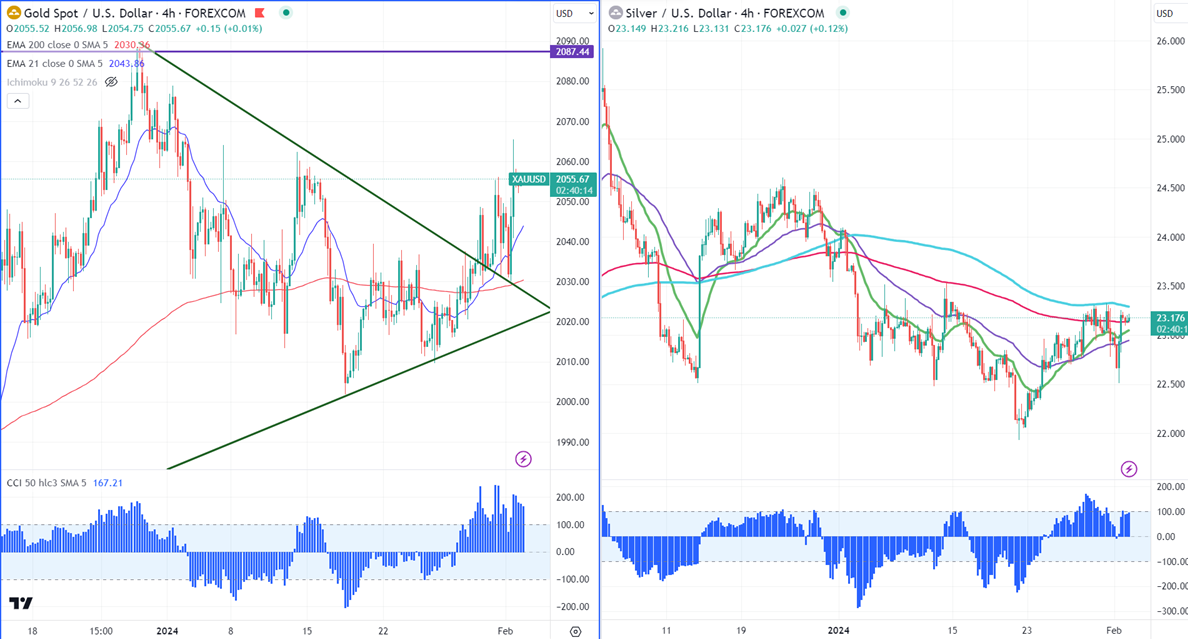

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $2036.94

Kijun-Sen- $2029.12

Gold trades higher on the weak US dollar. Markets eye US Nonfarm payroll data for further direction. Any upbeat US jobs data will be positive for the US dollar. The yellow metal hit a low of $2030 yesterday and is currently trading around $2041.53.

US ISM manufacturing rose to 49.10 in Jan, above the forecast of 47.20. The price paid index jumped to 52.90 from 45.20. The number of people who have filed for unemployment benefits jumped to a two-month high of 224000 last week, below the estimate of 212000.

According to the CME Fed watch tool, the probability of a no-rate cut in Mar increased to 63% from 50.90% a week ago.

US dollar index- Bearish if it closes above 102.70. Minor support around 103/102.75. The near-term resistance is 103.75/104.50.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $2043, a break below targets of $2030/$2015/$2000/$1970/$1956. The yellow metal faces minor resistance around $2060 and a breach above will take it to the next level of $2070/$2080/$2100.

It is good to buy on dips around $2025 with SL around $2010 for TP of $2065/$2080.

.

Silver-

Silver has been trading directionless and struggling to close above $23.60 for the past month. It trades above 21 and 55- EMA and long-term MA (200- EMA) in the 4-hour chart. The near-term resistance is around $23.60 and a close above confirms a bullish continuation. A jump to $24/$24.60 is possible. It is immediate support at around $22.50. Any break below target $21.90/$21.50.

Crude oil-

WTI crude oil prices dropped more than $5 after hitting a multi-month high. The easing geopolitical tension in the Middle East dragging the oil prices down.

Major resistance- $80/$83.50. Significant support- $77/$74.

Feb 2nd 2024, US NFP (1:30 pm GMT)

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close