Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1989.73

Kijun-Sen- $1978.53

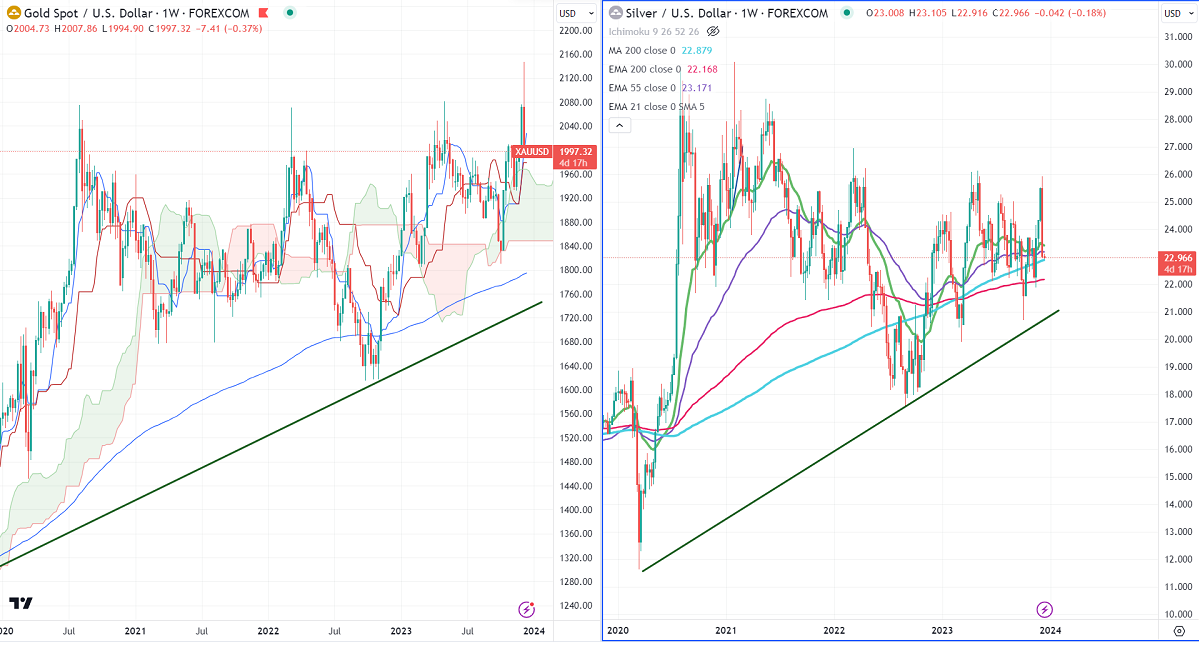

Gold was one of the worst performers the previous week on board-based US dollar buying. It hit an all-time high of $2146. It is currently trading at around $1996.56.

The US economy added 199000 jobs in Nov, compared to a forecast of 180000 Unemployment rate declined to 3.7%. US ISM services PMI rose to 52.7 in Nov, compared to a forecast of 52.

Markets eye major central banks' monetary policy (Fed, ECB, BOE) for further movement.

Major economic data for the week

Dec 12th, 2023, US CPI (1:30 pm GMT)

Dec 13th, 2023, US PPI (1:15 pm GMT)

Federal funds rate (7:00 pm GMT)

Dec 14th, 2023,

SNB policy rate (8:30 am GMT)

BOE monetary policy (12:00 pm GMT)

ECB Main Refinancing rate (1:15 pm GMT)

US retail sales m/m (1:30 pm GMT)

US dollar index- Bullish. Minor support around 102/100. The near-term resistance is 104.40/105.

According to the CME Fed watch tool, the probability of a no-rate hike in Dec increased to 98.4% from 97.1% a day ago.

The US 10-year yield showed a minor pullback of more than 4% after upbeat US jobs data. The US 10 and 2-year spread widened to -49% from -34%.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1970, a break below targets of $1950/$1932.The yellow metal faces minor resistance around $2000 and a breach above will take it to the next level of $2020/$2050.

It is good to sell on rallies around $2020-21 with SL around $2035 for a TP of $19952

Silver-

Silver dropped more than 10% after hitting a multi-week high. The upbeat US non-farm payroll data has decreased the chance of aggressive rate cuts by the Fed in 2024. Markets eye Fed policy statement for further movement. Any hawkish tone by the central bank will drag the precious metal further down to $20.50.

The near-term resistance to watch are $23.42,$24/$25. Minor support is $22.60/$22/$21.80.

Crude oil-

WTI crude trading weak for the seventh consecutive week, the longest losing streak since 2018. The decline in Chinese crude oil imports and weak Chinese economic data put pressure on the commodity at higher levels. It hit a low of $68.80 on Friday and showed a minor pullback after upbeat US jobs data. Major resistance- $75/80. Significant support- $68/$63.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges