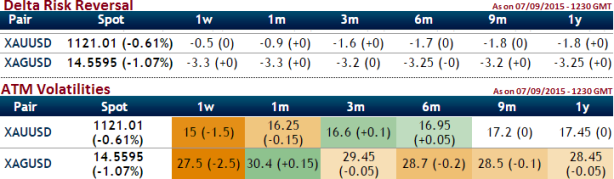

One can think of shorting not only on precious metals but investing in silver has proven highly riskier than gold. You can observe that from above the nutshell that runs us through volatilities of ATM contracts and delta risk reversal that would shed some light on trend projections. Huge volatility in near future is expected (25-30%) with negative delta risk reversal signals that the hedgers are equipped with put instruments as the bearish trend to prevail.

From last 4 years or so both gold and silver has been ruthlessly tumbling, since Jan 2011 silver reduced almost upto 71.17%, a massive slumps from the peaks of 49.780 to the current 14.567 levels. While yellow metal has tumbled 43.72% from the same point of time from the highs of 1920.80 to the current 1121.49 levels.

Despite this huge losses in commodity both are still showing starvation for further slumps as you can figure out from the downward convergence on both leading oscillators. Also on the Comex, silver futures for September delivery declined 15.8 cents which is 1.07% to settle at $14.54 a troy ounce by close of trade. On the week, silver futures inched up 3.4 cents, or 0.06%.

Hence, considering prevailing downtrend, traders in this commodity are advised to spare their negligible portions of profits and hedge any unexpected disruptions in this trend. We recommend selling near moth OTM calls and buy far month OTM calls, the hedger deploying this strategy being a bit skeptic on bullish momentum in the long term and is selling the near month calls with the intention to ride the long term calls for free.

FxWirePro: Comparative analysis hints silver CFDs more risky than gold; XAG/USD calendar spread for hedging

Tuesday, September 8, 2015 8:00 AM UTC

Editor's Picks

- Market Data

Most Popular