A glimpse over fundamentals: The bearish forecast reflected the view that the ECB would be quieter on the taper in the near-term. Moreover, markets appeared better prepared for an ECB taper than for the onset of Fed balance sheet normalization, as reflected by already-long EUR positions and overshooting valuations vs. rates, so any rise in yields was expected to be led by the US.

On the other hand, AUD, by contrast, is likely to be weighed down, firstly by its stand-out sensitivity to China sentiment (underlying economic linkages and Australia’s status as a liquid proxy for China), and secondly by the downside risks to RBA policy in 2H’17, including from a housing market that’s not liking its macro-prudential medicine.

There’s the risk of a tactical bounce in AUD from next week’s CPI (more infrastructure spending?), but this should be short-lived and RBA’s cash rate review in 1 week of August.

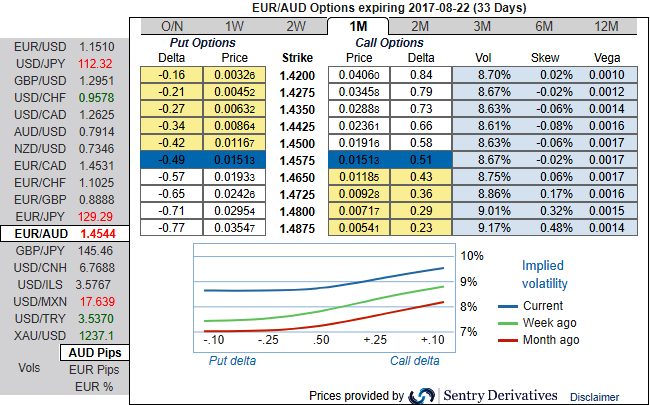

OTC Outlook and Options Strategy: In the case of optionality, the skews of 1m implied volatilities are projected to spike above the current realized (refer above nutshell), positively skewed IVs indicate bidding for hedging upside risks in the underlying spot.

But technically, the risk is essentially pricing in the bearish case, as it is linked to the possibility of volatile Aussie spikes. We articulate the euro’s technical trend against the Aussie dollar in our recent post.

For more reading, please go through below weblink:

Thus, contemplating all the above underlying factors of EURAUD, we like being short vol in short run, selling that premium conditionally on a pay-off benefiting from a lower spot.

Prefer a ladder to a call spread ratio As we expect limited spot appreciation and topside volatility, we recommend buying a 2m call ladder. Buy 1 ITM Call of 2m tenor, simultaneously stay short in 1m 1 ATM Call and Sell 1 OTM Call of positive thetas (strikes 1.4245/spot/1.5080).

That structure improves the odds compared to a call spread ratio as the maximum and constant profit zone is reached over a range instead of a single spot level.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data