Before we jump into the core area of this post, let’s just glance through some fundamental driving forces. The oil performance has been instrumental in boosting the Canadian currency so far in conjunction with the BoC’s rate hiking speculations.

Even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014, and our USD rates projections can realistically drag the USDCAD to 1.35. Since February 20115, the pair has been oscillating between 1.4689 on north and 1.2037 on the south.

In this write-up, we emphasize to take advantage of high carry-to-vol, with the Fed in a slower gear than the markets expected here we widen the net by employing no-touch structures as a passive play on limited upside in high beta FX. No-touches can be seen as defined downside alternatives to selling naked vanilla high beta & EM puts and are well suited to take advantage of the modestly risk-positive environment that should emerge after the trade dust settles.

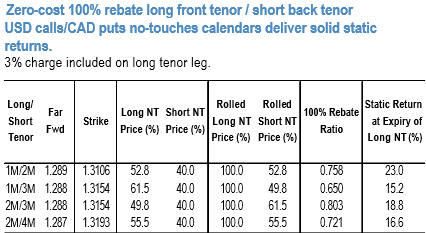

As shown in the above nutshell, one can configure calendar options structures that come in costless, buying front tenor no-touch (NT) and selling back tenor NT with the same barrier and notional adjusted to assure zero loss in event of the barrier getting triggered.

At the current market, the strategy collects solid static returns in case of USDCAD (+1M/-2M 23% of the 2M leg notional of static return –i.e. if spot stays unchanged after 1M –at expiry of the long no-touch leg).

With CAD at the moment out of the trade crosshairs, consider the following as a low-cost slow Fed play: Long 1M vs. short 2M USDCAD call no-touch calendar @1.3150, in 0.8:1.0 ratio notionals, spot ref 1.2929 costs 4.8% USD.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different