Kudos for continuing to joyride on USDCAD's non-stop streak of upswings on 11 and half years' highs.

Speculators don't really appreciate the options until they understand equivalent positions, hedgers least bothered as long as risk is mitigated.

While holding your luring USDCAD spot FX long positions, some minor abruptions can also not to be disrupted the portfolio as the pair has been unstoppably surging.

So as a resultant effects of profit bookings by risk averse traders, the pair may show some minor dips.

In order to give leveraging effects to the current portfolio consisting of spot longs, it is advisable to initiate following positions.

Costless collars = Spot FX longs + short 2D OTM (2%) calls + long 2W ATM -0.49 delta puts.

The main intention of this strategy is to effusively hedge existing long spot FX outrights with little or no cost since the premium paid for the protective puts is offset by the premiums received for writing the covered calls.

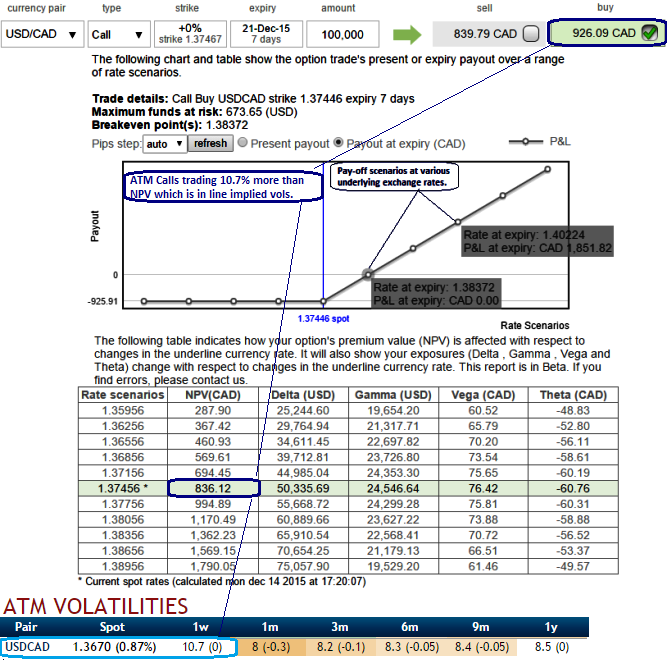

And motive behind choosing OTM calls for writing is that we found no reasons for shorting ATM options as they seem fairly priced in (see diagram), that is moving sync with implied volatility. So, bucking the trend is only brave move here, on top of that using rightly priced options for writing would be highly risky venture.

Depending on the volatility of the underlying, the call strike can range from 30% to 70% out of money, enabling the writer of the call to still enjoy a limited profit should the stock price head north.

FxWirePro: Costless collars for hedging and speculating unstoppable USD/CAD bull swings - calls moving in line with IVs

Monday, December 14, 2015 2:03 PM UTC

Editor's Picks

- Market Data

Most Popular