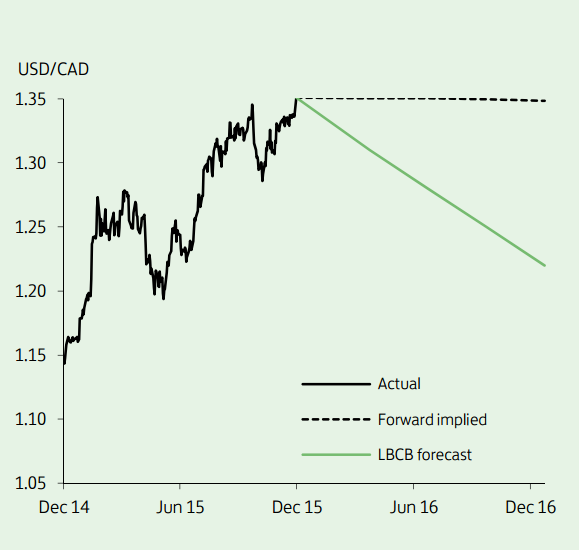

A continued fall in oil prices and the heightened prospect of an upcoming rise in US interest rates has pushed USD/CAD to a new 11½ year high above 1.35 in recent days. While the move has largely reflected a generalised improvement in the USD, concerns that Canada will suffer disproportionately from a glut of global crude oil have also weighed following OPEC's latest decision not to pare back its current production.

Near term, the crystallisation of a US rate rise risks pushing USD/CAD higher still into 2016. Nevertheless, it is believed that we are approaching a top. The Canadian dollar has already dropped around 15% against the US dollar this year, with the fall imparting a significant competitive boost to the Canadian economy. Although Canada's GDP shrank by 0.5% in September, latest figures for Q3 as a whole showed annualised growth of 2.5%, led by a strong (9.4% annualised) rise in exports.

Away from energy, output is generally holding up well. The divergent performance of Canada's economy - between the energy and non-energy sectors - should narrow over the coming year if oil prices turn higher.

"While the risks are skewed towards further CAD weakness near term, we look for a steady recovery to 1.22 by end 2016", says Lloyds Bank.

USD/CAD Outlook

Friday, December 11, 2015 12:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX