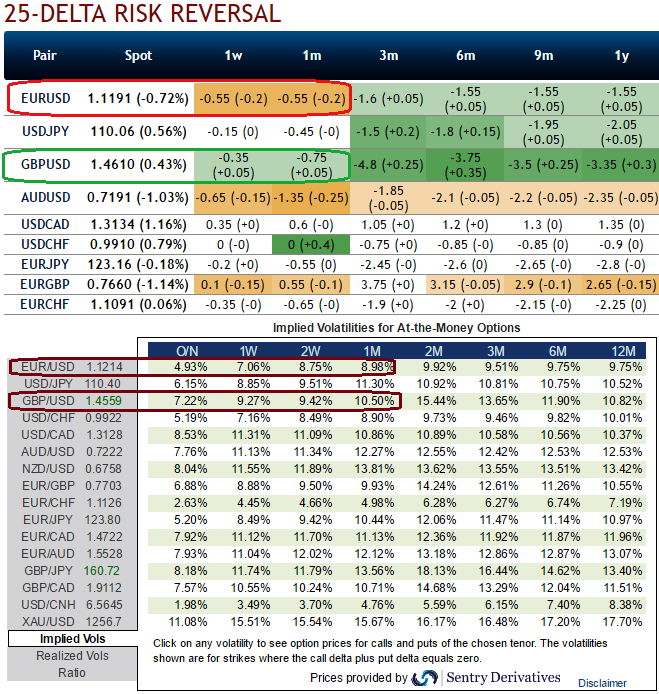

Before we begin with hedging framework let's once glance over OTC updates as to why do we prefer cross hedge between these pairs, we are particularly emphasizing on 1m risk reversals.

Please be noted that the risk reversals of EUR/USD of 1w to 1m tenors are signalling overpriced puts as they print negative flashes, while GBP/USD of 1w to 1m tenors signal positive to neutral hedging sentiments, as a result calls seem to be on higher demand.

The usual reason why cross-hedging happens is that because of the price difference or inability to find right derivative contracts on the same underlying whose risk needs to be hedged in any of the exchanges. Also this happens when the liquidity of these contracts is not really that great.

Well, let’s now visualize a trader decides after seeing above OTC nutshell for in the near month EUR/USD options that indicates overpriced ATM contracts; therefore he tends to short the volatility. And suppose we are shorting an ATM call option with an amount of 100,000 EUR. Currently, 1m IV of EURUSD and GBPUSD is 8.98% and 10.50% respectively.

If the delta is negative 0.5 since this is an ATM EURUSD put option, the amount would be -50,000 EUR in spot outright. To remove this potential risk taking place when the underlying market moves, we can buy 50,000 euro against dollar in the spot market anticipating euro to go up and take the same position in GBPUSD options as it was in GBPUSD.

This allows the delta neutral position. If prediction goes accurate then profit is certain by shorts on call option with nil risk as the market moves around as long as you continue to update the Delta hedge.

But always keep in mind that shorting an option in this case means returns are possible only when volatility falls.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close