WTI crude oil lost its shine on weak Chinese data. It hit a low of $81.58 yesterday and is currently trading at $82.27.

China’s second-quarter GDP rose 4.7% YoY, below market expectations of a 5.1% growth. Chinese industrial production came above the market forecast of 5.3%. June retail sales missed estimates, rising 2% vs the forecast of 3.3%.(negative for industrial metal Silver).

The escalation of Middle East tension supports oil prices at lower levels. The easing of US treasury yields increases the chance of a rate cut by the Fed in Sep.

Major factors for crude oil price movement-

US dollar index (Bearish)- Positive for Crude.

Major resistance - 105/106.20.

Major support- 104/103.

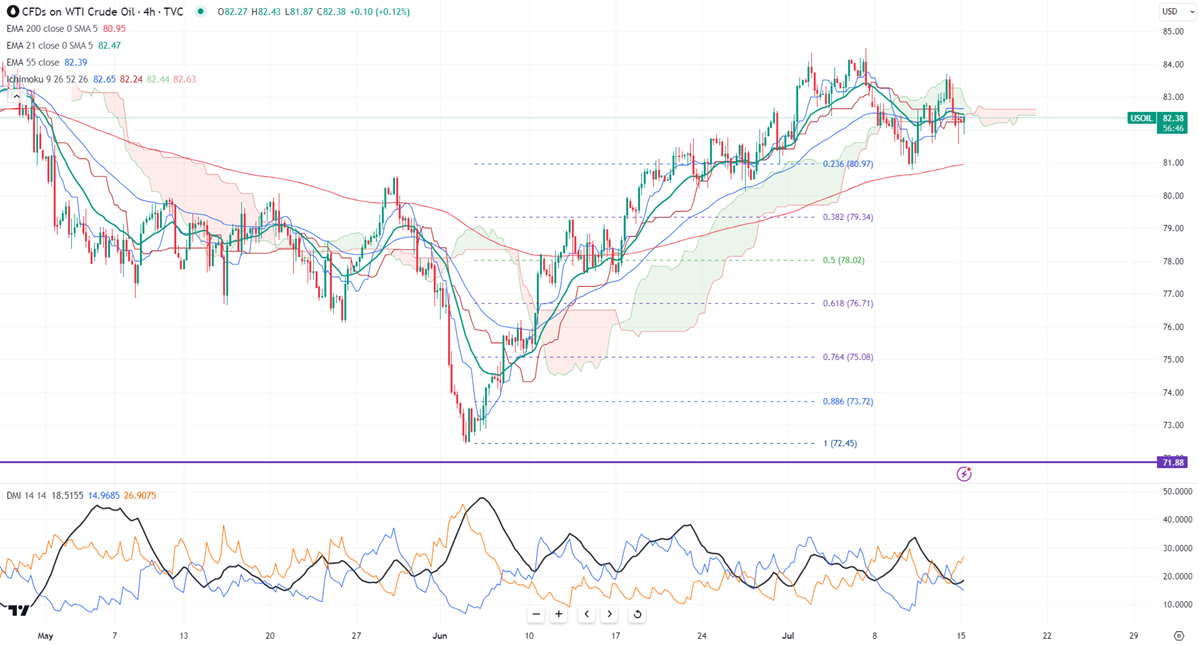

Ichimoku analysis (4- hour chart)

Tenken-Sen- $82.65

Kijun-Sen- $82.24

The immediate resistance is around $82.60. Any jump above the target of $83-/$83.75/$84/$84.50/$85. On the lower side, near-term support is around $82. Any breach below will drag the commodity down to $81.50/$80.

It is good to buy on dips around $82 with SL around $81 for a TP of $85.